How did those "middle class tax cuts" work out for you?

I'm hoping to find some time this weekend to bang out my return and figure out how deep up my ass Trump went... anybody taken the plunge already?

I paid less taxes than last year and so far my refund will be around the same as last year. Winning...

Return? What's that? I'm not in the habit of giving the government interest-free loans. I'll be mailing in a check... just not sure how much it's going to be for.

And for me, I'll be comparing the percentages paid rather than total tax because I made quite a bit more last year than I did in 2017.

I just did my this week. The new standard deduction of $24k was more then my itemized deductibles so I guess that was a good thing. Still went through the whole process on TurboTax but then when I was done it said I was better off using the standard deduction.

if you want an answer to that, meet with a CPA and have them analyze your tax returns and tell you if the changes helped or hurt you. tax law is complex and your scenarios change annually so the is many factors outside of the tax law change that have an impact on what you paid this year vs last year. simply looking at your return check from this year vs last year is probably not an accurate assessment. don't be confused by your "refund" compared to last year, especially if you used to itemize but now claim the doubled standard deduction. Since the withholding tables changed to reflect the doubled standard deduction less money is being withheld from your paycheck in the first place which means less refund because you were not overpaying throughout the year.

Here are just some reasons off the top of my head why someone's refund would be less than a prior year:

made more money

had a change in dependents or a child turned 17 years old in 2018

adjusted federal withholding intentionally (outside of the automatic adjustment per the IRS)

change in income type (i.e. ordinary income to self employment income)

change in pre-tax deductions like retirement contributions or insurance

repayment of healthcare subsidies or penalties for not having insurance

penalties from early withdrawal of a retirement account

elimination of education credits because one or both spouses (or kids) didn't attend school

Even with the SALT deduction elimination If your home is worth less than ~$1M you'll have a net cut.

"The new standard deduction of $24k was more then my itemized deductibles so I guess that was a good thing."

Not when you consider that you lost the $4,050 apiece in personal exemptions for you, your spouse and your children that you used to get ON TOP OF the itemized deductions. But now there's a flat per child tax credit that may balance at least some of that out. I'm really not sure which way it's going to go... I'm stopping for the BIG bottle of bourbon on my way home tonight, lol.

"And for me, I'll be comparing the percentages paid rather than total tax because I made quite a bit more last year than I did in 2017."

Enough to put you in another tax bracket? Because that would be your doing, not Trump's :)

I usually have a lot of deductions, child, mortgage, property tax, and my biggest deduction, car miles for work. That usually drops my AGI down way low that I pay low taxes and get a Nice refund no matter how much I change my holdings. This year after I did all that itemizing I was told to use the standard. So I guess that was better??

“My tax was less but my refund was the same.” That’s hard to do unless your withholding changed. Guess it must have.

I pay more, and that’s after prepaying a lot of my property tax last year. More important, and perhaps the guide you should use, my effective tax rate went up. Highest in a decade.

Supposedly, 1 out of 3 middle classers will pay more. Hardest hurt will be high property tax states, usually the ones with the better schools, and people in those states who could avail themselves of deductions. Basically we can no longer afford to work at home.

I am only part way in, still waiting on some 1099’s so this too could change but certainly I will not be on the plus side. Please enjoy the extra bazooka I put in the pot this year. Use it profitably :-)

Where’s that Trump promised special middle class tax break? You know, the promise he made right before the midterms?

FYI, not even close to $1M house, Skippy.

my federal taxes are less this year, a lot less, so thank you President Trump

my state and local taxes? they are higher, so boo to that,

Can't wait until Murphy's "RAIN TAX" is signed into law!!!

HAHAHAHAHA AOC should be our governor, we're virtually socialist already! She'd fit right in! (no wonder for the exodus...)

Pretty tough to complain about the federal SALT cap when our very own state has been capping the property tax deduction for years.

SD I didn't change anything on my W4 form.

The middle class ranges a lot. A family making over $200K is still middle class but that's a lot different than a family earning $100K. I doubt the family earning $200K or more is hurting unless they've put themselves in debt by living beyond their means. The upper middle class and the rich that can afford more luxurious homes with higher taxes may take a hit, but the average person in our area should be fine. I personally don't want to buy a home in NJ and will probably be leaving before my youngest starts school in a few years.

Just sayin if you’re waiting on a 1099int or div your not hurting lol

The median income in the US is $59,039. If you are making that in NJ you’re hurting - so In a national scale yes the middle class for tax cuts. In NJ the median income is 76k and property taxes are astronomical - that’s why you’re not seeing the gains you want.

https://www.businessinsider.com/middle-class-income-us-state-2017-9

Which is why the REAL middle class of NJ are leaving. The ones like SD banking off their investments have nothing to complain about.

Plenty of chatter on twitter already about refunds being smaller, or owing more money, than in the past.

"Enough to put you in another tax bracket? "

LOL, no... but for the sake of arithmetical simplicity, say I grossed $100k last year and wound up paying $12k in federal taxes after all of my deductions and what not. That would mean I had an effective tax rate of 12%

Now say that this year, I grossed $120k... if my taxes are $14,400, then I broke even at that 12% effective tax rate. If it's higher, then Trump raised my taxes; if less, then he lowered them.

Just be glad you aren't self employed- do much more work, much more risk..than just going to a 'job' every day- yet get taxed substantially higher even if you gross the same amount.

Did mine and I paid less in taxes, a lot less, compared to 2017.

However the change in the withholding tables mean less return. That means more in pay check throughout the year and less of an interest fee loan to the government.

As others said you can't look at your return you need to look at your tax liability which was definitely less. Another win for Trump.

But did pay more in state taxes. Not surprised, can't wait for Mr Ed to start taxing breathing.

Josh,

Yes, you are "taxed" substantially higher", but that is because you are paying both the company and employee SS taxes (Ie. the self employment tax). Most of that money is already deducted out of people's paychecks. You just get to pay that in one lump sum. As for the employers 1/2 of the SS, you at least get to deduct that amount from your taxable income on top of the standard deduction so it's not as bad.

“If it's higher, then Trump raised my taxes; if less, then he lowered them.”

That’s false too... even if he did *nothing* your effective tax rate would be greater because everything additional in your top marginal bracket (say $77K if you’re married) is weighting your effective rate slightly higher towards that 22% or 24% bracket.

In 2018 (assuming no deductions to keep it simple) $100K would have had $14,260 in taxes (14.26% effective rate) and $120K would have had $18,660 in taxes (15.55% effective rate).

Mets, must be IRS formula change so you got more on your paycheck.....would make sense then.

Again folds; the effective tax rate is what tells you whether you’re paying more per each $1 of income. Mine went up.

Very funny Skippy, and no, this is not about who’s hurting; it's whether you are paying more. I am paying more on the Fed. And the effective tax rate tells you plain and simple. Most tax packages will run out a few years for you.

And while you feel my pain; remember I took a big hunk off by prepaying property tax and in a weird manner, have a lot of 1099Rs which inflated my Federal but bypass the state because pensionable. I think, still early yet. So, My state actually covers my Fed and my total bottom line is OK. So it turns out OK, but won’t next year.

It was a weird year for me; usually don’t get many 1099s much less Rs but had some life changes.

Still, if my effective tax rate went up, the Trump tax plan did not benefit me and the answer is the $24k standard deduction was less advantageous than the previous set of deductions.

So I paid for an extra foot of highway. MAGA. It was a good ride.

I still owed this year (for Federal taxes)... but compared to last year:

2017 Tax / 1040 Taxable Income = 19.03%

2018 Tax / 1040 Taxable Income = 16.70%

Yes, deductions and exemptions were different (both due to the tax code and starting an HSA account, etc.) but at the end of the day my taxable income went up and my effective tax rate (and actual tax dollars spent) went down.

jnnjr - It's not a lump sum because if you did that you'd end up with a penalty for not paying enough up front. People in this situation have to make estimated payments so it's not quite an all at once hit.

I'm hitting the SALT cap. From the discussions about how the deductions are close to a wash I can see a lot of families here. Single filers aren't as lucky particularly if you have a lot of deductions. My total effective rate is up a bit over 3% if I compare the same numbers from this year and last.

Gc, did you prepay property tax last year. If not, and I did; I think I’m in to 1-2% higher. Would make some sense.

"if I compare the same numbers from this year and last."

I think the problem is various people are using various numbers. Some probably look at Tax vs. W2 income, some probably look at Tax vs. Deductions, some people just look at the refund amount, etc.

I don't know if there's a "right" way, but I chose (a few posts above) to compare "Total Tax" vs "taxable income" on the 1040 for the past 2 years and at least with that calculation 2018 was better for me.

SD - No prepayment, even if I had the cash, I'd just be kicking the can down the line for this year.

Mark - There is a right way because in the end what matters is how much you make vs how much you give up. How much you give up when is more a matter of choice than anything else so comparing against the refund is not very meaningful. (just change your withholding if that's what you want) Comparing against your income after the deductions isn't right either because the deductions are part of how the tax rates are figured. What matters to us in the end is comparing all income, whether taxable or not to see what we pay. "Taxable" to some may be things like ordinary income vs municipal bond interest/soc sec benefits/etc, and to others might be income before deductions and income after. Also "W2" income isn't everyone's situation, some people are employees, some business owners, some both. And some people have investments or rental income. My definition of income includes all of those things before any deductions or other adjustments. That's what I'm comparing to my total tax bill.

I agree with what you're saying re: refunds, etc. (that's why I brought it up... a lot of people are just saying they got more/less back this year as an indicator for whether the tax code was better/worse).

Using your suggested formula (total tax / total income) for me:

2017 = 15.15%

2018 = 14.06% (2018 total income was also 2.1% higher than 2017)

2018 still wins.

However, I think the *best* way to do it would be to back feed 2018's numbers into a 2017 tax calculation and then compare that to the 2018 actual. That would isolate how the "rules" themselves affected the outcome for the *exact same* financial scenario. (i.e. maybe my 2018 rate went down because I had more capital gains vs. last year but the loss of the personal exemption actually hurt me and that was "hidden" in the noise).

That sounds like a lot of hassle though... ;)

You’re computing an effective tax rate which is the way to do it. So you gained a point; $1 on every $100; $10 on every $1,000.

However, as your taxes get more complex, you may see things like credits below the lines or those long term losses than I will carry for decades.

So, if your tax package runs it, use theirs. At least it’s consistent. But you’ve got the idea.

Ps: you’re paying too much :-)

We’re also completely discounting the time value of money and missed opportunity cost in prepaying property tax - I’m not sure that the salt deduction pays off in that scenerio

“Ps: you’re paying too much :-)”

Some of that is probably the single vs married “penalty” (i.e. I jump up to 22% and 24% brackets sooner than a married filer would - it’s possible that taxes on the same total income is “cheaper” for joint filers).

Plus, investment strategy differs... taxable vs deferred (or tax free), taking losses now vs later, etc.

I don’t know if you work for yourself, but there are possible/partial deductions there that a salaried employee couldn’t duplicate (travel, equipment, utilities, etc.)

You may also be beyond the SS tax cap... keeping 6% more of each dollar above that limit (weighting your total effective rate down - in a good way).

Honestly, I really have a simple financial situation and beyond 401K and HSA contributions, mortgage interest, and property tax I don’t have many obscure deductions

to get that extra percent or two off my income.

Simply put, I had to PAY fed.tax lasts. This year i'm getting BACK $1,800. IT's working out just fine. Now I'm looking to move out of state an save more.

Pretty easy Skippy; opportunity cost is your effective tax rate. Pretty sure aiming for low double digit profits is a riskier opportunity than saving that amount.

Of course, I could of put in a new kitchen floor, valued that like Trump values his brand and decided it was worth billions.

No Skip; a savings of 10% or higher usually means I don’t do too much thinking if I can afford the freight.

I paid $16 less this year. I filled out the 1040, then just for fun did it again using the 2017 form and instructions, and compared the Total Tax figure. And for me, itemizing deductions worked out better than using the standard deduction.

Missed opportunity cost is the gain that would have been realized at the standard rate of return if invested not the effective tax rate and the time value of money is the delta between the value of money when you paid your tax till when it was due. It’s reasonable to believe that you could have done better doing it that way. It has nothing to do with your effective tax rate. If you don’t care about 10% in your scenario so be it.

for me it worked pretty well. We had over $10,000 more than what we would have had with previous tax law.

Sorry Skippy. Like school, I should have shown my work given I tend the shorthand the whole affair. Pecuniariat Intuitivium.

OC’s are really just alternative values for an amount. Not sure what a “standard ror” is. Time, etc. would all be apples to apples.

My point was, using a 10% effective tax rate, one year planning period, let’s say $10k property tax, I will save $1,000. Although I will wait a year for the 1k.

Now, either that’s the standard return on the 10k as OC or I need to find an OC return value for the 10k that’s greater than $1k or 10%. Standard or not, finding 10% in this world means risk. $1k in my pocket is a sure thing. Obviously, same planning period.

Now, I could work the $10K for an entire year. That’s risk, that’s work, versus immediate gratification, no risk, no worry, no work. And I need 10% with $10k at risk; what’s the value of monitoring that?

3% is the current no-risk ror; and not for just one year period; you need to lock it aeay for more time.

I just shorthanded my effective tax rate and said NFW am I going to work that hard.... Frankly, if I could standardly do 10%, I would hire a CPA. Until then, on JIT’s coerced theft payments ;-) I will take a 10% bluebird all day long. (a bluebird is free money, no risk, like what taxpayers give banks for excess reserves they are too lazy to work. But that’s another story :-)

Hope that clarifies. Loved the definition.

Bottom line look at your at total Federal Taxes withheld it is lower - your Tax return is on you or your Accountant.

The Feds took less for your labor...and that Social Security Trust Fund is in T Bills comment- not sure the color of the sky in your world = probably Red thats what the color Socialists like.

If US Dollar goes in the tank = so does your T-Bills and Social Security.

lol = clueless totally clueless

Got it - ROi = return on investment.

Understand the risk component for sure - I just don’t like giving any government money before I absolutely have to lol

Hmm, so this is apparently part of the formula... some people aren't "paying more taxes", they just didn't have as much taken out in payroll, therefore their refund is smaller. They don't actually have less money, they just have less of a refund.....

It's offensive how the media takes stuff like this and turns it into "they lied, you aren't getting a tax cut"... it's NEVER as simple as it seems, and it's a damned part-time job searching for the WHOLE story...

"...the changes complicated payroll withholding, so that not enough money was withheld by employers in many cases, meaning that people now owe more taxes. The new law also capped IRS deductions for paid state and local taxes, including real estate taxes, resulting in a nasty surprise for many filers."

For those willing to share, I’d be interested to know what your NJ property taxes are to see how that new rules capping that deduction amount is affecting us.

Skippy, roi, ror, whatever :>) But I did "don’t like giving any government money before I absolutely have to" by giving them money a year in advance....to pay 10% less on that money, just had to wait 12 months for the payoff :>) To me, that's absolutely on time!

Wow... " If US Dollar goes in the tank = so does your T-Bills and Social Security." So, tell us, rude and snarky one, what's your solution when the dollar goes in the tank. The T-bills will fail well after than useless lettuce under your mattress.... :>) Or maybe you'd have us put it in gold; if the dollar fails, how you gonna get that, rob Fort Knox?

JR: read your own piece: "The new law also capped IRS deductions for paid state and local taxes, including real estate taxes, resulting in a nasty surprise for many filers" Hello, McFly, anyone in there?

But I think you are on a right track and that many people's taxes are being affected by withholding. Apparently, when the IRS adjusted their withholding recommendations, they went too deep so many happy people during the year will become unhappy at tax time..... Lots of rationalizing about this all over the place. The conspiracy types see government overreach to make you feel better during the year --- immediate gratification. Worked here :>) Others say its just one of those things and it was your fault for not overriding the recommendation. Yeah, right :>(

Many will pay just plain pay more Federal Income Tax. My example, using the Effective Tax Rate as the measure, is still correct. The rate is higher, I pay more, withholding included. Many people, especially in NJ, CA, NY, HI, OR, IO, VT and DC will be in my boat. We have high property taxes, or state taxes, or both, and high deductions under the old system.

We work from home and those massive deductions that disappeared were not compensated by the increased personal exemption. And we made more than previous years so at least that dulls the pain.

But my 1 out of 3 will pay more MAY have more to do with withholding. I don't know, can't find it again, and most are saying we are early in the cycle so these early returns may not categorize the entire field. I expect we will see a conclusion for this once more returns are filed. But whether they withheld more or less, made more or less, the Effective Tax Rate will tell the tale.

Yeah, bad enough that I may seek an office. I actually feel the WAH payments for heat, electric, internet......but not phone (VoiP remote extension....). Oh well, not much longer for me....kinda….halfway there already. May see you in NC soon. But, of course, you will never know :>)

Effective tax rate of 5.6%... got a little less than $500 back when I was expecting to owe at least $3k. Another $2k refund from the State. I feel a lot better than I did when I woke up in a cold sweat this morning, lol.

"Effective tax rate of 5.6%"

How much money are you laundering (or losing in the stock market) to get that rate?

Can someone tell me what I will pay in taxes please , social security income 23,796 and 7000. Capital gains , thank you , worried I will owe a lot but can’t do taxes until papers are in single filer

I dump 10% into my 401k and max out my medical and childcare flexible spending accounts (7500 total b/w the two). There is also a $2.1k credit (not deduction) per kid these days. Then all of the exemptions for the $6k in health insurance premiums and dental premiums, etc.

I actually had it turn out that the standard deduction was better than itemized, which surprised me slightly, although the uncertainty definitely had an adverse affect on charitable contributions...

The total federal tax bill came out to $9k, of which 2,600 was SE tax on my wife's contract invoices. The total Fed income tax,exclusively, was only 6,500, which would work out to 5.6% of about 117k, which means that Turbotax doesnt even factor in the 401k contributions, because my gross plus the wife's "profits" exceed that by quite a bit.

Yeah that may need you to itemize not sure.

SD I’ll keep an ear out for the liberal that got dragged behind a pickup lol

Capital gains have nothing to do with itemizing (they aren't deductions). They are just taxed at different rates depending on whether they are short term or long term gains.

No idea why TurboTax won't work for you, as I've never used it. I do my taxes online (FreeTax USA) and it's always accepted everything I've entered with the appropriate tips and error checks.

Don't know what the final tally will be, but we made A LOT more money last year with SS increase and the booming economy causing my stocks to skyrocket. I guess my name says it all...USAfirst.

cowgirl1 if you are a senior, thru AARP people are available by appointment, no charge, at various libraries to help you through

"Yeah, bad enough that I may seek an office."

DEAR GOD HELP US ALL

...I may have to, in that case, run against you :)

If you have the Deluxe TurboTax it doesn't walk you through the forms for investments, but you can open the forms and complete.

Yes, TT Deluxe can be a ROYAL PITA for things like capital gains, profit sharing, bonuses being paid with stock options.... every year we have to call the broker (Merrill-Lynch) to figure it all out ...

Won't know until we go to our accountant. We wait until the last minute every year. With the raise on the AMT limits, that alone will probably put us into the black. For thef first time in years.

Media is already spinning things. Headlines of 'people receiving smaller tax refunds' have already started. They need basic math courses. Refunds are totally up to the individual. If you want a bigger return, withhold more.

Early data can shift a lot, tax experts say, but there’s reason to believe frustrations could rise as more Americans complete their tax returns. The Government Accountability Office warned last summer that the number of tax filers who receive refunds was likely to drop for the 2018 tax year, while the number of filers who owe money would rise.

The GAO pointed to an IRS estimate that about 4.6 million fewer filers would receive refunds this tax filing season. Another 4.6 million filers were likely to owe money who had not had that experience in the past.

"We made out great. More money in our pay checks and still a refund."

You're lying, just like Trump!

Or, you're RICH, because only the RICH got tax cuts, because Trump hates America!

;)

I LOVED the tax cuts !!! More money in my pocket always make me happy.

MAKE AMERICA GREAT AGAIN !!!

Thank You Donald and 4 more years !!!!!!

Haven't done ours yet, it's on the list for next weekend. This is all interesting info.

My husband is self employed so I withhold enough to cover both of us.

I was nervous about the change last year and manually increased withholding on my W4. Hopefully we'll either be OK, or get a good refund. If the refund happens I'll 'unadjust' my W4 to get that back in the paycheck.

I think we still need to wait to judge the effects as the early returns do not necessarily describe what is coming.

It is pretty certain that a number of folks will be surprised.

Some, like me, will just pay more. We will tend to like in high tax states like CA, HI, OR, MI, IO, NJ, VT and DC and have high deductions. The $24K increase did not cover the deductions that disappeared.

Others will have gotten money back during the year via reduced withholding. Some may get a surprise as it appears the IRA withholding number may have been a little deeper than probably intended. Whether on purpose to make you feel better, or an accident, it may surprise a some folks

Others will see a reduction both in payroll taxes and in what they file April 15th.

When Reagan did his cuts, he phased them in to avoid some of these surprises. Hopefully Trump's won't need it and the ones that occur won't be that bad. In my case, it was expected, although one always dreams for a better future :>)

What's to worry about? If our tax returns are smaller that's good; it means Trump is taking our money to build that wall we want, right?!

Winning!

More money in each paycheck, less 'refund', just as it was intended. No surprise at all.

The money has to come out of somewhere. Do you honestly think the federal government was just more fiscally responsible this year?

Are you suggesting Trump isn't fiscally responsible? Show me any evidence that this man was ever fiscally irresponsible.

" Show me any evidence that this man was ever fiscally irresponsible."

Atlantic City

NYC Banks

Bayrock

The Deficit

The Debt

The Tax Plan causing the Deficit, the Debt

His statements on reconciling the debt

SD you really were asleep during the Obama years.... You're really gonna blame Trump for the debt.... Sure some more has piled on but it isn't because of the tax cuts. It's continual reckless spending that congress has done nothing about. Getting us out of continuous wars will help. There are probably countless programs that are complete garbage that could be cut to save money.

“There are probably countless programs that are complete garbage that could be cut to save money.”...Mets

Like giving $1.5 trillion to corporations? Dump the “give more money to the ultra wealthy“ program ,for starters. It’s obvious tRUMP has criminals, all around him. They know how to STEAL!

What programs do you think should be cut? Trump’s “working vacations”? Extra staff for patrolling the shores of Mar a lago? Two floors, in tRUMP tower, for security (millions of dollars), so Melly can go to a fashion show? Security at camp David? A place too dumpy for rTRUMP. Paying for his overseas dictator school and condo sales visits to Asia? I could think of lots more waste, that needs tending to. What programs do you want cut?

He is trying a Reaganomics move, doubtful the economy will burst and bust like it did before, more likely just Peter out...

Funny how the first year of the tax cuts, the debt didn't increase any more dramatically than under Obama.

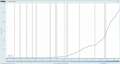

https://www.statista.com/statistics/187867/public-debt-of-the-united-states-since-1990/

So what was Obama's problem every year when the government was still getting the ultra-high corporate taxes? These numbskulls couldn't balance a budget if there was a gun held to their heads.... Has nothing to do with taxes, because people end up spending more when they have more money in their pockets.

I’d bet some of those complaining about taxes going up (or not dropping a huge amount) for them are approaching or exceeding the top end of “middle class” which is $60K to $174K in NJ (for a family of four). When you have ~$30K+ just in deductions you’re pulling in a good amount of money to begin with.

Isn’t that what Democrats (that you voted for) want? The more you make the more you pay in taxes? Congrats! You’re in the upper class now!

I need a definition of "ultra-high" when it comes to a discussion of corporate taxes. I seem to recall the one-percent doing quite well during the Obama administration.

Andy corporate taxes are not the same thing as the rich personal income... Some corporations were being taxed close to 40%. So again, tell me where that money all went when Obama was in charge.

Maybe the stupid or unlucky ones....METS

Average US Corporation Effective Tax Rate is under 30%....

Here is a 2016 report on global corporate tax rates. https://taxfoundation.org/corporate-income-tax-rates-around-world-2016/

Exactly how is any entity entitled to 1/3 of what anybody earns? How do we justify that on moral grounds? How much is too much ? Why?

https://tradingeconomics.com/united-states/corporate-tax-rate

Went from 35% to 21%.

Made the same prior year. Less bonuses made this year, but literally same salary. I’m a Democrat living in Trump world. Federal deposited in my bank account 11 days later and $600 more of MY money back.

Keri,

You need to pay the existing money you owe first before we can lower your bill.

Your current balance is 100,000,000,000, plus interest accruing daily.

You have only been paying the minimum amount due, plus a little more.

You are constitutionally held to paying this money as long as you continue to be a resident.

There is NO WAY your NJ property taxes are going down, unless you buy a smaller or older home. Or possibly a piece of land and pitch a tent on it. Or possibly start living like the Waltons and divide your cost of the taxes. Or start some sort of real or fake business and write off parts of your property as if they are your office, etc.

Get a better or 2nd job. It's raining now and we are planning to tax your runoff.

Mets et al. You need to understand the difference between tax rate, marginal tax rate, and effective tax rate.

You’re talking apples n oranges mush here. E-bear—marginal tax rate for comparison— come on. Mets, highest tax rate are a measure. Of what? Everyone; I got more or less on my refund: don’t mean much with knowing a comparable factor....

I realize this ain’t quite balancing a check book simple, but try using the Effective Tax rate to do your comparisons. Chances ate that’s the number that will give you apples-to-apples.

Look it up as to what it means: it makes sense. Please folks, try effective rate for comparison. You’ll have a more harmonius outcome.

And Iman; think it’s the effect maybe a payroll tax that might throw your chainsaw math off; good enough for govt. work however. I’m just shocked you didn’t get tossed into the AMT. The only time I was in your effective rate neighborhood, I had two full college, huge losses, two surgeries, and a mortgage. And I got whacked with the AMT.

A better way to describe this, except they are joking.

https://www.youtube.com/watch?v=1z-AxgueBRk

Just add those tax breaks to the govt credit card.

The national debt has passed a new milestone, topping $22trillion for the first time.

The Treasury Department's daily statement showed Tuesday that total outstanding public debt stands at $22.01trillion.

It stood at $19.95 trillion when President Donald Trump took office on January 20, 2017.

22,000,000,000,000 US Govt Debt

100,000,000,000 Debt to NJ Retirees.

That zero key gets a real workout.

SD and other leftists, you know you can always send more to DC and trenton right ? Why pay the minimum? You vote for politicians who raise taxes. Why not just raise your own like the good citizen that you profess to be ? Why not send a nice big check? You could even use an Obama stamp and include a love note to bob mueller. Tax cuts shouldn’t matter for the leftist. If they want bigger government then fund it yourself.

And again. Despite your stale condescending attitude effective corporate rates were still too high in the USA before the cut. https://s3.amazonaws.com/brt.org/archive/Effective_Tax_Rate_Study.pdf

dodgeball, if too many people start living in tents they are going to tax the hell out of it.

The economy is a piece of pie, yes it can grow, modestly, along with population growth and more so with technology that lowers costs, but it really is a static pie (and always is at any given moment). Let's just assume a moment is a year, then as a society the pie needs to be divided. Capitalism does the dividing and society says it is fair. Unions and the public sector strong-arm the taxpayers whop have no recourse but to move. Just understand these basic principles if you are so inclined...

"You vote for politicians who raise taxes. Why not just raise your own like the good citizen that you profess to be ? Why not send a nice big check? You could even use an Obama stamp and include a love note to bob mueller." - - - - Electric Bear

LOL!! almost spit my coffee all over the keyboard !!! +1 man, spot on correct, and you also right ont he money when you say - - -

"Tax cuts shouldn’t matter for the leftist. If they want bigger government then fund it yourself."

Another big wet and sloppy +1 to that. If the leftists want more government then they should be offering more of their own money to fund it. Couldn't have said it better myself. (now i'm gonna need a whole new cup of coffee)

"SD and other leftists, you know you can always send more to DC and trenton right ?"

Why don't you just match my tax burden and pay the same share that I do? That seems fair to me :>)

Condescending attitude? You were using the wrong comparative factor. Just trying to avoid you looking stupid. Not sure how to sugar coat that, not my style.

Interesting chart, here's mine although not sure why the CBO would differ with the OECD. Don't matter; think either view indicates that corporate taxes needed some re-engineering, not an overhaul. https://www.npr.org/2017/08/07/541797699/fact-check-does-the-u-s-have-the-highest-corporate-tax-rate-in-the-world

You're chart shows about a 20% difference between US and OECD country effective corporate tax rates. Trump's corporate tax gift was a 40% reduction in tax rates (published, not effective) which seems a bit extreme for a 20% problem.....

Good chart, thanks. I did not expect that much of a difference. .

Keri-

Now what can we do to get our NJ property taxes down?

I agree, what can we do ?

"Why not just raise your own like the good citizen that you profess to be ?" - - - Electric Bear

right on.

The damage that a high corporate tax with multitudes of potential deductions is incalculable. How much capital gets diverted from productive activity simply to service arbitrary tax policy and in the pursuit of ‘compliance’? Whether it be marginal or effective rate, why should the US be so high ? To fund the ever expanding government leviathan? Fight the war on drugs? Fund the war on poverty ? And before you talk about the $22 trillion. Cut spending. Each line item. Cut it in half and watch that debt evaporate. We spend entirely too much money then intend to tax the piss out of our economy to pay for it. No. Not right. Do with less. But in your case, write a bigger check if you like. Nobody is stopping you.

Bobbob

It's easy.

Move. There are plenty of other states to choose from with lower taxes.

Each individual in NJ, including children, owes over 90k to the retirees.

It's about time you pay up, it's accruing interest.

Stay or leave and pay, those are your 2 choices.

1) @Keri&Bobob,

Property Taxes NEVER go down. Even IF property taxes in some area in America goes down, it's ONLY because the "Cost of Living" (whether you include or exclude the Inflation rate) in that area, you MAY see that slightly decreased -- Yet, most likely just remain flat/the same.

The worse, most contradictory situation I saw was during the Financial Crisis (when many people lost jobs, house prices fell, considered the "Great Recession") thinking Property Taxes would/must go down, INSTEAD, (since the township likewise starting losing money), the Property Taxes went up?!?, and why, because instead of getting the money difference from the Govt/Fed (or deal with the loss the same way we have to do), they (all the township heads who are personally selected, not part of the residents we can vote/impeach/fire for) find it better to put the town's own people in a deeper financial rut or duress (increasing/filling in their pocket with higher property taxes).

However, all aside that, I do agree we (not really us directly, but via our elected representatives {particularly Governor}), can follow/amend/refine [close some of the loop-holes or gaps on CChristie's] 2% CAP or decreases on the increases (by cutting the township's spending and/or SHARING CORE SERVICES) on property taxes.

So can only hope Gov.P.Murphy upholds one of his PropertyTax election promises.

#2) On the "middle class tax cuts" in this forum, which Bug3/ianimal and others brought up one should NOT expect get bigger paychecks or double personal/child exemptions, WHILE retain the same big Itemized deductions and/nor get Bigger Tax Returns.

Isn't the whole point of paying taxes is to do so while playing-on-an-even-field? (Well...as even we can get)

One way I believe this year's The Tax Cut and Jobs Act is doing so via CLOSING SOME GAPS on those who pass their earnings through many various Loop-Holes sitting in itemized deductions, PLUS the change in our Tax Bracket Rates, etc.

Nevertheless, reading a recent article on this: "The outrage over plunging tax refunds is premature", an interesting point says:

"Both the IRS and the Treasury Department said they used the same formula to set withholding rates that they had before, and designed the plan to minimize both underpayments and overpayments."

Which to me lends we may or should like having/getting a more consistent, accurate, stable tax returns or bills year after year.

How many of you like GUESSING (or how many have guessed closely right on) how much your Tax return or Tax bill is each year?

To me, it always comes to a difference of +$1,000 to -$2,000 - which unsettles me (hurry to reallocate funds to cover) each year.

My property taxes went down twice in the past twenty years. I agree they never go down, but there it was. Think I was happy? Both times I figured I was paying too much for years and NOW they finally got it :-)

Fact is we have the highest property taxes in the US.

The result is anyone who is mobile (the retired, don’t have to work wealthy, job mobile, the unemployed) can leave and save money; often real money. NJ is literally uncompetitive for these citizens.

We need to do a little redistribution of the tax targeting profile to better keep NJ for NJians.

NJ is a best state for working folks; wages are quite good for the agile. NJ is a great state for NYC. BJ is a great state to spend all that money and nuy stuff. Redistribute away from property that drives the mobile away and push it towards our drawing cards; jobs, spending, and wages.

That does not necessarily mean entire tax burdens would change but we should avoid special targets on folks who can easily up and go. When we are the worst in the nation, that’s a bullseye right on the mobile backsides of those groups.

"this pretty much sums up the NJ tax situation."

You forgot to include the toll gate to leave...

Biggest problems with taxes quite simply is a conflict of freedom.

Nobody should be forced to pay for things that they don't use, heck may not even believe in.

You want something? - pay for it.

You use something? -pay for it.

The whole - 'spread it all around equally' is stupid and ignorant.

Most of what I am robbed of taxes for, I have nothing whatsoever to do with and never will. Should not have anything to do with me.

Our Father

Who art in Washington

Hallowed be thy name–Uncle Sam.

Thy kingdom come,

Thy will be done,

On earth as it is in America.

Give us this day our daily benefits and entitlements,

And exterminate our enemies in Syria, Yemen, Iran and North Korea.

As you did in Vietnam, Hiroshima, Nagasaki, Tokyo and Dresden.

But lead us not into freedom,

And deliver us from our responsibilities,

For thine is the tuition grant,

And the housing voucher,

And the flood insurance

And Social Security,

Now and forever

Amen.

https://jesusontaxes.liberty.me/the-lords-prayer-revised/

A quick question: I have not yet received my 1099 form from the SS office for my earnings Social Security for 2018. Has any one got theirs thru the mail yet? I know I can get it online but just wondered if people on forum have received theirs thru mail already.? Thank you

Maybebaby - create on-line account (you will need to do so at some time any way) and you will have ALL your statements. My husband have received his SS statement by mail this year already, I didn't.

Lena thank you.I do have an on-line account and we just went on and printed it out thank you. I was just wondering if it comes thru the mail and if everyone got theirs already. I was worried that mine ended up in another persons mailbox by mistake. Thank you for telling me your husband got his but you didnt. So maybe mine is on its way still. But I did print it out from online a few minutes ago. Glad you answered my question. Have a nice night.

https://itep.org/amazon-in-its-prime-doubles-profits-pays-0-in-federal-income-taxes/

Amazon, which doubled its profits and made more than $11 billion in 2018, won't pay any federal income taxes for the second year in a row - Based out of Washington state, which has no income tax, Amazon has also been free from state filings on income.

time to remove their USPS subsidies as well

Thanks for pointing out that the Trump corporate tax cuts, "When Congress in 2017 enacted the Tax Cuts and Jobs Act and substantially cut the statutory corporate tax rate from 35 percent to 21 percent, proponents claimed the rate cut would incentivize better corporate citizenship. However, the tax law failed to broaden the tax base or close a slew of tax loopholes that allow profitable companies to routinely avoid paying federal and state income taxes on almost half of their profits."

https://itep.org/amazon-in-its-prime-doubles-profits-pays-0-in-federal-income-taxes/

https://www.nytimes.com/2018/03/29/us/politics/trump-amazon-taxes.html

trump is all over amazon but you are correct that act is the reason.

"While the tax cuts generally took effect on Jan. 1, some companies, including Amazon, have managed to deter or postpone tax liability from prior years as part of a grandfather clause included in the law,"

https://www.politifact.com/truth-o-meter/statements/2018/may/03/bernie-sanders/amazon-paid-0-federal-income-taxes-2017/

“From 2011 to 2016 Amazon reported a total $8.2 billion of pre-tax income and $944 million in federal income taxes, which amounts to a tax rate of 11.4 percent in the last five years.”

Well, NYC - a decidedly Democrat/Liberal location if there ever was one - is also giving Amazon a $3B tax break to build one of their HQ's there. ($1.7B from the state, another $1.3B from the city).

Don't blame Trump for that one.

https://www.fiscal.treasury.gov/reports-statements/mts/current.html

The federal government collected a record $1,665,484,000,000 in individual income taxes in calendar year 2018 due to full employment as well - you can blame Trump for that one.

https://www.postandcourier.com/business/amazon-abandons-plans-to-build-a-new-york-hq-after/article_3da630c1-b1af-57b3-bf41-354ddebc8ed0.html

and Amazon apparently pulled out of that.

Amazon just announced that they are canceling plans for the NYC Headquarters. Even with the incentives (Give-aways by libs to libs), it wasn't enough. High Tax, Lib, states make it impossible for anyone to conduct a successful business.

In other news, according to the latest survey, 53% of Californians want to leave the state. This could be bad news for states like Texas if the Californians move there. They will bring their lib attitude with them. Before they unpack, they will be demanding their free government cheese. You see, libs are like locusts, they build nothing, create nothing, they just consume and tear things down. Just go to any site of a lib rally after it's over, the place looks like a sh&thouse.

did you see the deck on that? bad times

https://www.edelman.com/sites/g/files/aatuss191/files/2019-02/2019_Edelman_Trust_Barometer_Special_Report_California.pdf

here is the article - nobody can afford a house and the homeless are everywhere

https://www.sfgate.com/expensive-san-francisco/article/move-out-of-bay-area-california-where-to-go-cost-13614119.php

"You see, libs are like locusts." Now see. That's deplorable!

Amazon just balked based on not agreeing with the Queens/NY govt. --- they will not be hqtrd there.

Yeah, Trump is all over Amazon over taxes. Sure, that's what's got him upset....not paying taxes.....yeah.....he really hates that......can you say: WAPO.....

OK, I am coming down the homestretch, and will have my final effective rates very soon. Right now I am on both sides of paying more or less. Using my SOP, I pay more, but not that much. But if I dump the full IRA amount for the wife, I pay less. Still got a little fine tuning to do, it's very confusing. Appears the new standard deduction is pretty much a push against the massive deductions I could take for WAH, Charity, Investment and other deductions. For me, it just means some change given I had structured my life around these deductions and now will probably move away from some.

I am all in for simpler, just takes a bit to get used to the change. Reagan's version was much simpler than this and seemed more fair all around.

Kind of funny how everyone wants to get out of blue states like CA, NJ, NY, etc... I thought the Democrats had all the answers? LMAO... We'll probably be leaving in the next few years. With my background I could make my same salary in a cheaper state where housing isn't outrageous and we'd live much better.

"The federal government collected a record $1,665,484,000,000 in individual income taxes in calendar year 2018 due to full employment as well - you can blame Trump for that one."

One would expect EVERY year (save ones with severe economic downturns) to collect a record amount of individual income tax, with our debt-based inflationary economy being what it is and population growth, etc.

I don't know if that is anything that necessarily deserves credit or blame... but I'm sure Trump will certainly take credit as it being some huge measure of his great accomplishments and his idiot followers who have no capacity for logical thought will simply believe it to be so. But, hey... at least he's not Hillary (-;

You want to talk about economic downturns... If Kamala Harris gets elected next year slap another $32 trillion to the deficit in the next decade after that with her medicare for all nonsense that abolishes private insurance. See, there's your logical thought. Or if AOC gets her way and plane travel and any use of fossil fuels are gone by 2030, including cow farts, enjoy eating Ramen noodles for dinner when the economy completely implodes on itself. Oh and then we'll probably get conquered by China and Russia because they never stopped using those fuel sources. LOL... It wouldn't matter how much taxes we bring in. Congress would find a way to overspend and expect the President whoever that may be to sign it. It doesn't matter who the President is. As long as you keep idiots like Pelosi in office for 40 years at a time, nothing will change. Her district is just doing super....

I'll give Donald this … he can brag about how things are the greatest ever and still keep manufacturing crisis after crisis to drive the news cycle and keep the attention on himself … what a hoot!

Still? I don't think I ever was. It's not like he was some awe-inspiring candidate or anything, lol.

Now, Ron Paul 2012? Yeah, that one still stings a little bit.

You should stick to sports Andy. It's funny the Dems call the border a manufactured crisis and all the law enforcement down there sing a different tune. Gee who should we listen to....

Yeah agreed there I worked on his campaign - sad

Andy I thing Trump has some help from the MSM in generating crisis

My situation is similar to a few on here. I lost the 5 personal exemptions so that's a big hit and that doesn't offset the difference between doubling of the std ded less what I would have itemized. Luckily my RE taxes are nowhere near 10k so i'm not losing anything that i would have been able to itemize. The child tax credit is huge to me, that's a 6k credit vs what used to be 3k for me. I'm think that will help me to come out a little ahead of last year but I'm thinking it won't be a huge difference. My effective tax rate is usually only around 2% probably mainly from the child tax credit. We'll see.

My federal refund was direct deposited today.... not too shabby considering it was filed on February 10th.

Let's see how long it takes to get my money back from Trenton. Right now on their website, it says they're "checking for accuracy". Riiiiiiight....

I remember a time when $40,000 was considered a lot of money. That's more than Roger Maris made in 1961 when he broke Babe Ruth's single season record with 61 home runs.

Imagine what Maris would have made today after winning back-to-back MVP awards.

Our accountant finished and nope the new tax laws did not help … We still owe money after making huge adjustments last year … We do owe less but we still owe … the biggest thing we learned donations did not help at all and we were told only to donate to causes you believe not for a tax break .. So my local Fire Dept will be getting all my donations going forward … and if I am correct these law are only temporary for citizens but corporations tax break does not expire … so if 5 years back to paying lots and getting nothing back …

For us the effective tax rate decreased by .6 % compared to last year. We owe Federal and have a refund from NJ which will cover the payment to Federal with about enough left over to go out to dinner.

Happy that I increased my with-holding last year after they updated the schedule, it just seemed too good to be true. Otherwise we'd have been in a different situation now.

Next year I think we lose the child credit, so now to figure out what impact that will have. And then in a couple years this 'gift' will expire. Who knows what chaos that will cause.

Yep Trump fixed everything for businesses and screwed everyone else. All while he suckled the teats of racists and sexists. Good job America. Let's Make America not so embarrassing anymore. (MANSEA)

"Next year I think we lose the child credit,"...

Why is that? He or she turning 17 this year?

Are you all accounting for the money in your paychecks you gained when you say you're being screwed?

We got double on our return verses what we got last year and we only made an addition $7000 this year over last.

Effective rate will yell the tale.

I just am impressed with iman’s and Bryan under 5% effective rate. Never got there and only time under 10% for high deductions and credits and I got whacked with the AMT.

You guys using a tax program to derive that or you just doing the math? It’s a good one....and Im pretty good at this.

Still working mine, just went positive on the Fed so feeling better. Keep breaking Turbo Tax, heh, heh.... And am carrying a loss that will last a decade after Im dead. Good thing it was a paper loss! Gotta love them real estate rules. Idiots....

Received $10.00 more per month in the paycheck due to less tax withholding. Owe $1500.00 Fed tax this year as opposed to $500.00 refund last year. Same income as last year. So much for the GOP middle class tax cuts.

Are you all accounting for the money in your paychecks you gained when you say you're being screwed?

Metsman

Yeah Metsman, I'm accounting for the whole $1 and change my check went up.. Laughable that you all thought Trump was actually going to help you. Talk about falling hook, line and sinker! The only people here cares about, have the same last name as him!

But sheep will be sheep and Nobody can help that.

Stranger - I am using turbo tax. Eff tax rate was 2.49% which was slightly higher than past years probably because my wife started working a little more. My taxes are very basic. Income from jobs and dividends and itemizing mainly from RE taxes and Mort interest. So it looks like the 3k child tax credit does wonders.

Wow, Bry, and I thought I was a tax sinner hovering around 10% ;-).

Love it while it lasts; they grow up so fast (dividends that is ;-)

Wow, my effective tax rate is 21.1% (Combined Federal and State) for 2017 and 23.7% in 2018.

Using "taxable income" doesn't take into account any potential changes in the amount of deductions you were able to take off the top. For example, if you previously itemized and have no children, your "taxable income" may be much higher this year than previous years even if you made the same gross income. This is due to the elimination of the $4,050 personal exemptions when they increased the standard deduction to $12,000.

For example, if you itemized deductions last year to the tune of $22,000 for mortgage interest and SALT and filed Married filing jointly, you also were entitled to a further deduction of $8,100 for you and your spouse for a total deduction of $30,100. This year, the standard deduction increased to $24,000 but the exemptions were eliminated. So, in this case, your taxable income would have increased by $6,100 over last year.

Samiam I don't know what to tell you... My taxes went down $1800 for the year plus I got a refund that was nice. Without deducting my sons college stuff the refund was the same as last year. With it I made out pretty well. You must make a lot of money.

Folks, the best apples to apples view is effective tax rate, federal only.

Don’t want state because that’s a separate story, another government.

All of iman’s stuff is why it changed, but the effective tax rate takes all that into account, I think, and gives you a fair year over year comparison as well as comparison with your neighbors.

For example, I am pretty sure I can construct a Mets scenario where all that was true and yet my effective rate would rise meaning I pay the govt more pwr dollar of income. I just don’t pay it at tax time.

I think effective rate is really the only way to tell and I think you need the sftwre to compute. Everytime I do my own, get a slightly different er. Think it might be in the payroll stuff.

My federal effective rate was 15.17%. I am receiving a $1,617 refund vs $2,894 from last year. I retired on June 1st last year so my income was from working those 5 months and my wife and my Social Security along with IRA withdrawals. I had to file in three states this year. This years taxes should not be to complicated.

Effective tax rate increased by 1.1% despite having $4K more in itemized deductions. Salary was the same. Standard itemized deductions (prop tax, mortgage interest.) $4k increase was from medical bills.

Wish I had spent my money on that tax deductible airplane instead of medical bills and tuition.

Well we earned an extra 15k this year and my taxable income actually went up 26k yet my effective tax rate dropped another whole percent (down to 1.48%). Crazy. Thanks to that child tax credit of course. Without that I would have been screwed.

I loved the new tax. First time we ever got money back. At least enough to enjoy it.

Go Trump

We just got back from having our taxes done. "Middle class tax cuts" for us were laughable. We are paying.....

ETR 2017: 8%

ETR 2018: 10%

Exemptions taken for the whole family.

The extra weekly pay was erased, and then some, by lost itemized deductions.

Going from a refund in the thousands to having to write a check for the first time in 35 years. So much for home ownership.

Not a fan.

Agreed. The middle class are the losers with this tax plan. We went from substantial refunds every year for the last decade to owing quite a lot this year. Can’t say I’m surprised...

Our refund went down by couple thousand. But that is because 2 of our kids have moved out, 1 got married as well.

Accountant said the actually taxes paid on what we made is just about the same as last year. So we got extra money in our weekly check and still got a decent refund.

You guys did realize that having less taken out from your paycheck throughout the year would affect you tax RETURN right?

I am not really sure why everyone seems so surprised

Darrin - I agree with you. The IRS has a "paycheck check-up" tool on their website. All people needed to do was use it halfway through the year to see if they need to adjust their withholdings.

Darrin - Me and my wife both had more taken out and sent straight to the Federal Gov not state ... and we still owed ... next step add another 5% to my 401 and see how it shakes out ... and everyone these changes for private citizens is only temporary our taxes start going up in 3 years and and back to normal after 5 years... Note the tax breaks for wealthy and corporations are permentant ... something to start thinking about ... might be time to leave NJ a bit sooner then I planned !!!

Darrin/calico et al; again, if you compare the effective tax rate year over year, the orher numbers you noted just get bundled in.

So, notafan has an accurate comparison, Irishresq has an accountant’s narrative where the accountant said they paid the same amount, they say they got more back during the year, decent refund so it’s either the same or got more. — w/o the ETR, hard to really tell.

You can thank the Democrats who didn't vote for the tax cuts for why they aren't permanent. They needed more than a simple majority in the Senate for that to happen. Unless you're a family making around $200K or more in NJ, this state is hard to live in.

not true Metsman … then why is a tax break permanent for everyone but the middle class ? they had enough votes for that ? nope the rich take care of the rich …

I not only receive more in my paycheck weekly, but I got a nice return as well.

I am more than pleased !

Thank You Donald Trump

MAGA

"You guys did realize that having less taken out from your paycheck throughout the year would affect you tax RETURN right?

I am not really sure why everyone seems so surprised"

Probably because they were sold a bill of goods on a meaningful middle class tax cut. An actual tax cut would allow you to take more home in your paycheck each week while maintaining the same refund you were used to. Otherwise, you are just moving money around with no real gains.

Seems to me that those who got screwed the worst are high SALT homeowners without dependent children. That $4,000 credit for my two rugrats was a huge deal... the difference between getting a $500 refund and having to write a check for $3,500.

We made out good. After adjusting our W2's we still got extra cash each week plus a refund for the first time in years.

Yes, Iman—the SALT states get nailed. While you can blame the Dems since they are Blue states and they set the SALT, they are also our population and wealth states.

You can’t even blame the guy in charge, he just said yes and woulda said yes to any tax cut.

It goes back to Ryan and the freedom caucus; they wrote the bill. Ryan, IMO, is a good guy, but always a bit of a financial hardass. His ideas are pretty good IMO, but left unchecked, the crazier ones come forth. This one is insidious where it misses the Red States, hits the Blue states, but is muted for the rich and the smaller property owner. That’s well targeted.

They should have buffered this blow with some phasing so the States could react better.

Guess we can tell who has the bigger properties ;-(

Question remains of where is the special middle class tax break promised just before the midterm to be delivered before the mid term, no, wait, edit....promised to be there just after the midterms? If that does not signal that this tax break was not as favorable to the middle class, I don’t know what does....

Meanwhile: Iman—-can I borrow your Iherd for tax purposes :-)

Ianimal, before you make claims like that, I must ask, have you actually calculated what you saved VS. difference at the end of the year?

Money saved per paycheck - difference at tax return time

Are you ahead or behind

Even if this is TRUE, wouldn't you rather the money that is yours come to you as opposed to the government keeping it and not giving it back to you until once a year?

I will report back once my taxes come back, but initially I saved quite a bit in my paycheck deductions.

"wouldn't you rather the money that is yours come to you as opposed to the government keeping it and not giving it back to you until once a year?"

Darrin, personally I try to be as close to ZERO at tax time as I can. I don't even use the withholding tables; I have my HR department deduct a flat amount from each paycheck that I think will get me where I need to be at the end of the year. My withholding didn't change at all when everyone else's did.

But that's me... others like the "windfall" at the end of the year and have come to depend on it to take vacations, pay off credit cards or whatever. That's their right and they're entitled to be a little perturbed if the government's actions markedly changed that.

Personally, I have no problems with how I made out tax-wise as I noted previously in this thread... just one more reason to give my kids a big hug at the end of the night (not that I need another one).

I really don’t understand what you people are talking about...That tax law is for the RICH!! Not the middle class.. Our tax return was 1/3 of what we got back last year!! The little amount that was in my husband check doesn’t add up to the $4000 that we got back last year!!! If anyone votes for that IDIOT IN the White House again... The middle class as we call our selfs!!! Will be gone!!!! The RICH Are just gonna keep getting RICHER.... VERY SAD!!!

MAD!!!! I beyond agree with you. it's underhandedly called Bait-N-Switch come reality.

Liberty thinker you don’t know what you’re talking about. Look it up. They needed 60 votes in favor for them to be permanent. So Democrats blocked it from being permanent by not voting for it.

MAD so you’d rather a socialist get voted in and jack your taxes up even higher. Gotcha...

Just remember “middle class” means different things in different areas.

Nationwide (i.e. what should be most applicable when talkng federal taxes) middle class tops out in the low-mid $100K’s for household income.

If you are above that, and are getting taxed more, it doesn’t mean there weren’t middle class tax cuts.

If you pay a LOT in NJ taxes which aren’t federally deductible in their entirety anymore (why should other states subsidize you for those taxes?) that’s a complaint for NJ legislators and the governor.

While I agree it’s ultimately NJ’s issue, to force cold turkey seems unfair.

Likewise, NJ funds many other less affluent states with our Federal taxes. We are a Federal tax giver, not a taker.

Not as clear as mud as you suggest.

Think my final tale of the tape is in...….

Effective rate = 12.5% vs. last year's 14%. However, I have been gyrating due to rollovers, rmd's, and profit-taking, last year was brutal including paying the AMT. So previous three years really 11-12%. I get money back, I paid additional last year, but got double the money in back in each of the previous 3 years over this years.

Last two years, I have massive profits raising my income like 40%. It's funny money in that it always existed, I just was forced to cash out and pay the bill whereas I could defer it in previously.

Bottom line: Trump's tax plan benefited me even after the loss of SALT over last year. Prepaying my Property tax last year helped a lot. The loss of massive WAH and investment management deductions really hurt. I have $10K less in deductions year over year. If it hadn't been for the root canals giving us $30K in medical deductions, it would have been a dismal picture with Trump’s standard deduction. If I can't figure out the new game during this year, I will most certainly tank next year. Appears there are loopholes to be had, but they certainly favor the rich, like the deduction on investment interest. Who the hell borrows money to invest? Rich man’s game for sure……

So, the old tax version will be better for me next year but Trump’s tax plan was better for me than last year. Next year I will tank. Answer is to leave NJ……to lower the SALT.

Blame NJ... I bet most other states aren't complaining... Your Sheriff of Nottingham Murphy is just making it worse...

And you sound like you're not the average middle class person SD. Most people don't make a ton of money off investments. So sounds like you're somewhere inbetween middle class and rich. Any tax plan isn't going to truly hurt you.

Mets, I have not a clue what you are kvetching about. If you missed the Trump SALT attack; that’s the affecting change. Plus the death of WAH and investment cost deductions. A bit premature to tag Murphy for that.... Yes, NJ is tax bad. So are all the other populated states with higher incomes.... It was a targeted approach to tax cutting.

If NJ hadn't taxed the bejesus out us for all these years, it wouldn't be such a problem. And the high NJ property taxes have been subsidized by SALT deductions for years, and probably wouldn't be so high if we hadn't received anything off of our Fed tax bill.

I personally think it's the ultimate hypocrisy. No no no, the Fed can't tax us more. Only we can. How dare they. Murphy needs to deduct his 200k in property taxes.

SD....when I read “Mets, I have not a clue what you are kvetching about.”, it caused SOK...snot on keyboard, from laughing so hard. I haven’t heard anyone use that word since hanging with my cousins, in Brooklyn, years ago. And Judge Judy. This IS Warren County, after all....home of the infamous town of Oxford.....LOL

I’m waiting for the last minute, to do my taxes. I usually get corrected tax documents, from my brokerage house, in March. Their IT folks aren’t the best. Then, I worry about what a kerfuffle it’s going to be. אוי ואבוי !

"NJ property taxes have been subsidized by SALT deductions"

+1 meister, well said. This is the issue that must be addressed : NJ's draconian property taxes. You are spot on correct.

Just like the life expectancy has just gone DOWN for the first time in 100 years housing prices have no way to go up with the property tax rates we currently have. A 10 year freeze followed by a California-like plan is the only way.

Whether or not you +1 it, still doesn’t make sense. Property Taxes are part of SALT so self-subsidizing?

SALT deductions were about the fairness of taxing the same dollar twice....the fact is that removing them targets states with higher populations, wages, and taxes alligns with bluer states is an apparent benefit to the enacters.

These states, like NJ, pay more in Federal Taxes than they get back from the Govt. So, for whatever reason, NJ is taxed more at the state level; the Federal Goverment even taxes your SALT tax, including property tax, and then the Gederal Government spends most of NJ Federal taxes in other states.

So, when you pay $10k in property tax, at 10% etr, the Fed asks for an extra $1k that it didn’t pre-Trump tax cuts, which it then spends $600 in other states but only $400 in NJ. (Not sure the real ratio, I just picked 40/60 split).

I don’t see where Murphy has done or can do much about that.

SD, isn't that the point of a progressive tax system? The haves contribute more than the have nots. Whether that's a wealthy individual contributing more than a low income one or a wealthy state contributing more than one with less. ANY tax increase (or a deduction limit, which is an effective tax increase - whatever your flavor), will result in NJ contributing more than most states. NY/NJ/CA residents make more than other states. Democrats want to tax the wealthy, unless someone else does it, then they don't like it. The SALT cap does this. So the Dems want to eliminate it. They should LOVE it.

Rather than eliminate it, I think the limit should simply be increased to say, IDK, 20K? Then it really would hit the wealthy and spare the 'middle class'. I don't think there are too many middle class residents with 20k in property / income tax bills, save for some upper middle class folks. And try telling someone from the Midwest that someone paying 20k in property taxes and making 120k is 'middle class'.

Increase it to 20k and wealthy people with 200k property tax bills wouldn't get to deduct the whole thing. Would this not be 'tax fairness'? But no, it gets politicized, so eliminate it.

Well....I am a Dem but I don’t see any politics here except that this move negatively affects more affluent states and those states are blue.

The primary reason for a SALT deduction is that we decided that federally taxing state tax payments seems like double jeopardy or double taxing.

Over the years, via unintended circumstances, the SALT deduction impacted State taxation progressively, but that’s a complex story. Let’s just stick with taxing tax payments seems unfair.

As I noted earlier, my main concern was that it was immediate vs. phased. If I hadn’t prepaid this year’s Property tax, I would have really taken a 5-digit hit and that seems very unfair.

As to the rest, by next year, I will have compensated for most of this. Its OK.

SD you're right. How can you get taxed on money that is gone? Especially when it went to taxes. Incredible. Our only recourse is to lower property taxes by coming up with some other ways to pay for services. Local income tax?

True, it was initially to avoid double taxing and has morphed into a different animal. Using to property taxes to fund education is a very convoluted method way of going about it.

It's very political, the NJ Democrats campaigned on it, hard.

"Our only recourse is to lower property taxes by coming up with some other ways to pay for services"

another +1, and becuase of the Trump tax cuts more of us are actually talking about property taxes

Putting pressure on the tax and spend democrats in trenton is good thing, should be more of it

Simply put this in here for clarification purposes -- it may help someone out there better understand the issue at hand.

https://www.investopedia.com/terms/r/regressivetax.asp

Think you gots some apples n oranges goin on there.

Yes, our property taxes are the highest in the nation which puts us at competitive disadvantage to attract the mobile like the rich, wah’s, or retired. These folks can save scads by moving elsewhere and they are mobile. At minimum, that needs to be re-engineered to not target those groups.

But our SALT is also very high and that includes all state and local taxes so re-engineering won’t help that and, given our debt, there are no bluebirds to dramatically lower our burden there. Worse yet, the previous SALT deduction has the unintended consequence of helping to raise our SALT. After all, it was a deduction.....

And insult to injury, our Federal taxes flow out of the state and are not returned, so the federal tax we pay, on the tax dollars we paid to the state, are distributed to other states away from NJ. So, we pay on what we pay and then it goes away.

That’s some insidious taxation targeting blue states to the benefit of red states. And that seems unfair to me.

Here's some backgrounders. They do explain the "subsidy" theory, regressive, progressive nature of the SALT, I get what you meant by subsidy now, but even IF that's the case, is the best answer going cold turkey? I prefer the tax on a tax definition which makes this cap very unfair.

https://smartasset.com/taxes/trumps-plan-to-eliminate-the-state-and-local-tax-deduction-explained

https://www.taxpolicycenter.org/briefing-book/how-does-deduction-state-and-local-taxes-work

this one captures the pro's n con's. https://www.cpajournal.com/2018/01/22/congress-salt-deduction/

My earlier point about NJ's tax flows indicates that 20% of NJ tax dollars go to other states. So first we pay NJ tax which is a %12.2 burden on us. So $12,200 on $100,000 of income. Then we pay Federal Tax on that, which is a 16.5% burden in NJ, so $16,500 in our example. But within that, we paid $2,013 in Federal Tax on the $12,200 we paid to the State. In other words we paid tax on a tax..... Unfair.

41% of NJians used to take the SALT deduction.

And then to cap it off, pardon the pun, of the $2,013 tax we paid to the Federal Government, about $400 is given to other states, not NJ. Of the entire Federal Burden, about $3,300 is distributed elsewhere.

Again, I find it unfair to tax a tax and insult to injury is to do that and then given 20% of the proceeds to other states beyond NJ. But the biggest insult is that it was a flash cut versus a phased release. If we hadn't the fudge to be able to pay our property tax forward, many NJian's would have lost 5-digits or more versus previous taxes. While we can say they are the rich, actually they are the rich AND those who had deductions like parents with kids, kids in school, etc. A $10K hit is pretty extreme.

Using SD's logic (which I don't necessarily disagree with)...we get taxed on tax all the time...it's called Sales Tax.

Yes, we do. And I think I can show some dollars than have been hit 4 times or more over the years. One example is during the Clinton years, I got a huge bonus that I said --- let's get an IRA. No one told me about depositing more than the yearly discount number, or that banks did not track the data. So, being quite busy making the money, I just flopped it in, bought a 5-year CD and moved forward. Many years, and many bank mergers later, I discovered 1) records matter 2) pre/post tax matters, and 3) I had mud when it came to tracking. I couldn't even tell you the originating bank..... Wanna bet this was post tax and wanna bet I will pay tax on the basis...….again? Hey, God giveth, God taketh away :>(

But there is a difference in the SALT tax. Buying something is a choice. You can do it or not. You can buy it in another state. And not all items are sales taxed; unprepared food, household paper products, medicine, and clothing are not taxed except for the pot. The idea is that essentials are not double taxed, just disposable income purchases.

Paying taxes is mandatory. It is not disposable income. You must do it or go to jail.

IMO that makes this double tax more egregious than a tax where you do have choice.

screwed too. the new tax law is garbage. why bother giving us more money in our checks last year starting around march just to take it all back at tax time. and the salt changes didn’t help. just hoping all of our hard earned money isn’t wasted in concrete and metal at the border.

So finally got my taxes done and I got $2500 MORE then I got back last year.

Mind you I did have a child, but this couldn’t have worked out better for me. More in my paycheck every week and more in my return!!

The tax law isn't garbage, the taxes in NJ are garbage. I'm sure 45 out of 50 states are doing just fine with it. These blue states need to wake up and realize they can't keep taxing the crap out of people.

Again, the money back metric can be flawed. Only the ETR between the two years really tells the tale of the tape. But yes, Darrin, your extra dependent can help that the exemption is doubled to $2,000. But did it help more?

What it does say is that you don't have a lot of personal exemptions because, if you did, you would be a loser. So, as you and DJ mature, you will lose more and more against the previous plan.

https://www.cnbc.com/2017/12/20/families-will-feel-the-pain-of-losing-this-tax-break.html

SD you brag about all of your investments. Did you think you'd come out a winner with all of your assets? Even if you paid more it made no dent in your cushy life.

Is it bragging are you just suffering greenis envy?

How should State Taxes become a Federal tax issue depending on what state you liive in? That’s double jeopardy.

Why should the Federal goverment and red states profit based on what Blue states tax? And you think that’s fair and just. BS. More important is the flash cut designed for pure pain. That’s what really galls me.