23-Cent Gas Tax Hike/Ballot Question #2

N.J. Lawmakers Pass Christie-Backed 23-Cent Gas Tax Hike, Set To Take Effect Friday

http://patch.com/new-jersey/lacey/breaking-lawmakers-pass-christie-backed-23-cent-gas-tax-hike

LOL, it's like putting a condom on when the baby is 8 months along...

That petition has been around for over 6 months and has well less than 6,000 signatures.

Once again Trump wannabee Christie sticks it to the working man. This tax will fall disproportionally on people who drive the most. The disappearing middle class gets another hit to the wallet.

LOL ianimal.

Darrin - Unfortunately, petitions rarely amount to anything.

This sucks for all the Uber drivers that are trying to make a few extra bucks. I love the way the tax increase can go into effect on this Friday, but the sales tax decrease will take two years. That's code for, it's never happening. Sigh....

I wonder if NJT will raise their fares as well in light of the increase.....

I thought Christie was a republican. I'll still vote GOP for the national level but I'm going to have to think twice before electing another Republican governor of New Jersey.

My work's giving me an opportunity to move to Tampa permanently any time between September 2017 and January 2020...I may just take it up.

Petitions do nothing...

You want change, follow our lead from some runoff elections we had yesterday.

Incumbent candidates = Gone. Term limits for everyone!

1988LJ, i'm in the same boat with moving to FL for my work although my time-table is what i want it to be. if i want to move in a couple of months i can, if i want to wait a year, i can. they have put it on me basically.

this tax hike is just going to drive more people out of the state. people on the fence are going to be pushed over to finally pulling the trigger and leaving. i see no hope for NJ which pains me as this is where i've grown up and my roots are.

But he's lowering our highest-in-the-country property taxes so we can be highest in the country.

And lowering the sales tax by a penny so we have less usage tax than we used to. Since we can only afford the McDonald's dollar menu and The Dollar Store than means we will save 1-cent per item!!! If you buy 23 burgers at drive though, you can offset the increase in gas to get there.

Texas laughs at us.

That decrease in the sales tax from 7% to 6% translates to a 14% drop in sales tax revenue. Based on the current projected revenue from sales tax, that equates to a $1.5 BILLION decrease in annual revenue.

If the gas tax increase remains dedicated to the TTF, how does Mr. Christie intend to make up that revenue shortfall? Oh wait, he's planning on going to Washington if Trump wins, but in any case he won't be around in 2018.

Be prepared for more downgrades in NJ's credit rating.

With my current gas usage, my annual increase in gas tax will be right around $150. Assuming the sales tax reduction ever goes through, I would need to spend at least $15,000 a year on taxable items to offset that loss. As long as bourbon remains subject to NJ State sales tax, that's pretty much a no-brainer, lol.

And from what I read somewhere the 23 cents is not set in stone. It's based on the average price at the time. Thought I saw it was reviewed at certain periods throughout the year and raised or lowered proportionally. I think they said if gas jumps to $4.00 the tax hits around 50 cents. Cannot remember where I read it so I may be incorrect.

Damn, MB... 60 gallons of gas per week? Might be time to look into an electric car or at least a hybrid...

An absolute joke!!!! Let's not solve one problem and create a whole bunch more!!! This is a joke right?? This useless sack of crap screws New Jersey again!!!! Mabel for his next deal he can offer no more state income tax for a box of chocolates!!!!

http://www.nj.com/politics/index.ssf/2016/06/in_midnight_vote_lawmakers_ok_surprise_sales_tax_c.html

so they have a vote at midnight to get this in before the holiday weekend - YAY soprano state politics. The main problem is the general trust. There are no dedicated funds in NJ. That's how the state has been taking money from the "Transportation Trust" (in the form of bonds), and have been shuffling hither and yon, while the maintenance gets put off year after year. Now, while NJ roads are in a crisis, this time taxpayers are in a crisis too. Many of us are finding barely enough capital to keep families in food, let alone fix problems decades old, that we were told time, and time again, were going to be fixed this time around....

From what I have heard the 23cent increase will be dedicated to the TTF not meaning the politicians in Trenton wolnt steal it at a later date. With projects like the gothels bridge and bayone bridge being done to bring the big transport ships into port Newark without a TTF to make the roads and bridges up to par the roads would be unable to sustane the higher traffic. I can see why everyone is upset but the fund being broke puts thousands out of work. Not just a few there part of the middle class aswell. They have to eat pay mortgage's raise familys. The laborer the operator the truckdriver the manufacturing plants that build materials the company's supplying clothing boots the government Safty men and quality control. The deli they buy there sandwiches at and the big grocery stores they shop at. Its all a big loop . Don't be mad at the tax be, mad at the government for letting it get to this. As much as you disagree we need it and you know it

Where exactly does the current 14.5 cent tax per gallon go? Is it all dedicated to the transportation trust fund? I doubt it but can't find any data on it. Will the new. 37.5 cent tax be dedicated to the fund? The new tax revenues will not cover the decrease in the sales tax from 7 to 6% in 2018. With a new Governor that reduction will not likely take place. More smoke and mirrors from the NJ Legislature. Another year and a half and I'm out of here.

Who knows probably some nj senator's wife's boob job but it needs to be dedicated to the fund or in 5 years well be in the same boat.

It will cost the average driver less than $100 annually give or take. Average work commute in the Northeast is about 9k miles (2013-2014 data). 9000/25 mpg x .23= $82. For <$2 a week, I'm fine with it. Especially when coupled with elimination of the estate tax, lessening the tax burden on retirees, and the reduction in sales tax. NJ was one of only two states with an estate tax. Time to stop penalizing small business owners and farm families who worked hard to build their businesses.

And here's something else no one is talking about besides the actual math: won't it make people think about getting a car/truck that has better gas mileage when it's time to get a new (or used) vehicle? That alone could make it a wash, and benefit everyone (less pollution). Gas is cheap. Historically so and looks to remain so for the foreseeable future. If $2 a week helps fix our roads, isn't it worth it? Even at double is that really going to bust someone's budget?

If they could couple that with a reduction in waste, they'd really be getting somewhere.

That's a great theory, but what about those of us that need our trucks from time to time (hauling or bad weather), but cannot afford a second vehicle?

Great deal; the politicians mismanaged the fund then reached into *our* pockets to fix it instead of the harder option of trimming fat elsewhere in the political machine.

Sounds like a familiar tactic.

The data from MeisterNJ is correct based on the NJ average miles driven per year. I think my increase would be around $300.00 per year based upon miles driven. Not a big deal if the sales tax rate would remain at 6.0%; which will be questionable in my opinion.

The problem NJ has is under funded pension plans which in the coming years will require increased taxes just to cover the money due retirees. This is an unavoidable problem that will result in even higher taxes.

Paying a road tax isn't the issue.

Paying a "road tax" that is used for things other than transportation infrastructure is.

Obfuscation rules the day.

I would save money but this doesn't make any sense. The sales tax is ok, it is property taxes and estate taxes that need to be addressed...

MeisterNJ, I don't think it is as much about the actual dollar amount annually as it is the fact it is another way to tax the residents in an already heavily-taxed state. Yes, there already is a gas tax I understand so it's not necessarily a "new" tax but where does the line get drawn? At what point is enough enough? The politicians simply don't care because even with all the calls, petitions, and outrage in the end, they will most likely be reelected because the voters of this state are morons - and they know this. We have no one to blame but ourselves who continuously vote in the wrong people. And that goes for both sides of the aisle!

I think Chris should take the fat out of the roads budget. He should develop The Road Fairness Formula with Equal Funding For Every Road.

NJ Road Costs By The Numbers suck compared to any other state in the Union. We pay much more per mile than anyone else. A lot more. His Department Head says the reason is we are old, well traveled, and complex. Fire him.

There's an Inequity in NJ Roads Chris, so before you raise our taxes, how about making a better deal on what we pay to build and maintain roads. You can ask your new BFF who wants to help America to help. And then lower our taxes or raise them, but at least be a man and say "NJ pays for it's roads using a Fairness Formula based on what other states pay."

Otherwise you are a fraud jacking our taxes to cover a fat, bloated, overweight budget while slashing any possible educational salvation for poor kids. Either you're fair all around or not fair at all.

I should mention that 71k figure is both me and my husband. He drives a truck and it's not optional. I've looked into a hybrid for myself, but the higher cost of the vehicle washes out the savings in gas. Maybe with this increase I should look into it again, but I've only had my current car for 3 years.

This sucks!!!!

MB, buy a Tesla. It should cost you in the neighborhood of $70k so you'll make back all the money you lost on the gas tax (-;

Meister are you sure the estate tax piece made it to the bill. I thought I saw where it was left out along with some other tidbits.

I don't disagree Joe Friday, but they are reducing other taxes, so it's not even a net increase and possibly a net decrease depending on how things shake out. And it just brings NJ up to par with our neighbors. If it helps keep wealthy people and retirees(who tend to have more money than the average person) in NJ, which is not a given, tax revenue may actually go up while decreasing the overall tax burden per capita.

If each of you drives 35+ thousand a year and don't choose a car that gets good millage that seems like a bad decision if you chose a truck that let's say 16mpg correct me if I'm wrong but 35000 miles devided by 16 mpg thats 2187.5 gallons per year. Do the math with my Camry witch isn't a Small car gets 28mpg its 1250 that's a 937 gallon difference per year. At 2$ a gallon that's a savings of 1,874$ so don't be mad at a 23 cent increase mad at your choice of vehicle.

Of course but if you are a business owner and driving a your truck is gas not a write off? And if you drive a truck for a company does the company not pay for the fuel?

"write-off" doesn't mean it's free... it may be a non-taxable expenditure, so you save ~25% on your personal taxes if you get reimbursed. So the increase is only effectively about 18 cents per gallon.

"does the company not pay for the fuel"

What if you own the company that's paying the bills? The money is coming from somewhere, and you either have to raise prices on your customers or eat the difference for lower profit.

Iman: I have never been able to find the cost of electric to keep those Tesla's going. Just wonder how much you save (gas versus electric, not the cost of car :>)

My hybrid gets 50 mpg and Meister, I paid the price of a car, about 22K. Not the most elegant or peppy of vehicles so the $2.50 a galleon is killing me after this sacrifice. I actually smiled more at $3.50, go figure.....

Another case of JIT;s shuffling the deck chairs. Lower the sales tax and get some press to cover the disaster forcing him to up the gas tax in the middle of the night. Wonder which one he'll highlight on the way to VP.

My feeling is sure, I'll pay more tax especially if we use the extra to pay down the debt ---- there's a thought.... But if our roads cost more than any other state, increased taxes is not the answer.

Again Chris, where's the plan for lowering the price per mile for highways. And how can you cover a revenue downturn by lowering the sales tax. Where's the plan.

Exactly, Mark.

And Yep, I think you're getting caught up in the gas mileage thing and missing the point. Which is that they shouldn't need to increase revenue - they need to figure out why the cost of repairing our roads is so much higher than in other states. They need to fix the problem rather than slapping another band-aid on it.

http://nj1015.com/the-one-person-you-must-call-now-to-stop-a-huge-nj-gas-tax/

From the article:

"How about instead of raising taxes on middle and working class New Jerseyans, we simply dedicate 1 percent of the sales tax and the surplus revenue form the Turnpike authority toward the costs of roads?"

Meister read this please. Some of the other taxes you mention were pulled.

http://www.forbes.com/sites/ashleaebeling/2016/06/29/gov-christie-bails-on-new-jersey-estate-tax-repeal/#5cae67e1516d

estate tax stays as is, not being eliminated anymore; Sweeney is in a hard pace on this bill, he has a hard time supporting it in it's present form as he cannot support the reduction in the sales tax as he is well known for wanting a constitutional amendment to force the state to fully fund the pension fund.

i fully expect more cigar filled backroom haranguing for most of today and this evening with another 'emergency' vote late tonight. (by both house, the assembly and the senate)

keep calling your legislators, let them know how you feel about this,

Yep-

Some people don't want to drive some geeky little Toyota. We have standards, for God's sakes. Plus, although this is not my case, some people need trucks and SUVs to carry around kids or supplies.

Its not that the estate tax is so gosh darn awful; it's that is so gosh darned awful compared to most every other state in the Union. We need a Fairness Death Equation..... It's also a jigsaw to figure out the number....

Speaking of death: does NJ require you to have a lawyer to get through probate or are there sources, like web sites, to be able to do self-serve?

Gar Meister, shiver me timbers but with a full tank taking me over 600 miles for a couple of sawbucks, I am a Pirate, Gar! Master of the highway seas. Now if I could only fit more than one bag o booty in the hold.

Yeah neather do I but I'm smart enough to save my money and drive a geeky little car then drive a monster and blow money out my tail pipe . And put my kids in my 5 star safety geeky car as well . You want a flashy ride looks like you might pay more for it sorry

Your individual additional gas expenses is the least of your worries no matter what type of car you drive. Remember the last time gas prices spiked? It wasn't just your gas bill that increased. Prices rose on almost everything. The other problem is that people will have less disposable income so that means less buying power; stores/services that are operating with thin profits right now could be forced to shut down.

And yes, not everyone who has high gas bills has it by choice. As a 100 mile a day commuter, I'm not happy about this. I'll be buying my gas over the border in PA if it's cheaper...just like when it was close to $4/gallon.

"Remember the last time gas prices spiked? It wasn't just your gas bill that increased. Prices rose on almost everything.'

nail. head.

I don't care what the tax is. I'm not just paying the tax. What's the total price? If this tax puts it higher than a PA station on my route, I'm using the PA station. F' Trenton.

That's what most commuters will do as they travel in/out of NJ, emaxx. What a bad move.

The low prices in Jersey are what keeps PA's prices lower close to the border. You can expect PA prices to rise as well in reaction to this.

emaxx is right, these total tax revenue projections are being done on sales as they are currently exist right now. but if the price is at parity with ny, pa, and Delaware, then many out of state commuters will stop buying gas in NJ and buy it somewhere else, that will skew the projected tax revenues downward,

If 2 gas stations buy gas from the same distribution plant at the same price pa charges more tax than nj who's gas will be cheeper? Must be pa right?

Yep - there are a lot of other expenses in running a business besides the raw cost of goods.

Also, the word is cheaper, not cheeper.

I would wager that the price of the actual fuel may be one of the *least* costly items to running a business, especially if you want to compare PA to NJ for business taxes/fees/license/regulations/insurance, etc.

I recall there being some kind of subsidy on gas in NJ to allow the bay way refinery to be a thing - I may be mistaken but I know that was one reason that gas was lower in NJ - that was back in the 90s though

When gas was first spiking back around 2005/2006 and NJ had the lower tax, the Wawa gas station by the office in PA had gas way cheaper than anything between Hackettstown and there. I filled up weekly there. I would even swap cars just to fill up there.

I just paid $2.45 at Citgo on rt 57 for premium. Costco was about 25 cents cheaper according to my gas app. Both are top tier gas.

auntiel, this tax doesn't apply to diesel, only gasoline... but that doesn't mean that diesel prices won't rise as a result.

got this in an email from Jennifer Beck:

Good News: No Gas Tax Increase Before 4th of July Weekend!

Legislative Update from Senator Jennifer Beck (R-11)

senbeck@njleg.org 732-933-1591

Senate Fails to Pass Gas Tax Increase Today!

I have good news! We successfully prevented a 23 cent/gallon gas tax increase from taking effect before the upcoming 4th of July weekend. More than 9,000 people signed our online petition in opposition to the proposed tax hike. Because of your efforts, there simply wasn’t enough support in the New Jersey Senate to even hold a vote today. Your phone calls and emails helped to stop the billion dollar tax hike from taking effect tomorrow, but we still need your help. Democrats will try again to pass this tax increase before Labor Day. Keep on calling and writing your legislators.

You can find their contact information here:

http://www.senatenj.com/send/tl.php?p=28r/17w/rs/35x/sx/rs// http%3A%2F%2Fwww.njleg.state.nj.us%2Fmembers%2Flegsearch.asp

We need you to keep up the pressure until a transportation plan that doesn’t include a gas tax increase is adopted by the Legislature. Until that happens, the fight isn’t over.

Here’s what you can do:

Keep sharing the link to our “No Gas Tax Increase” petition at http://www.senatenj.com/nogastax.

As more people sign the petition, it becomes harder for legislators to vote for a tax increase. Find your legislator, then call and email them to say that you oppose a gas tax increase in any form.

Forward this to friends.

With your continued support, we can defeat the gas tax increase for good. Thanks!

Senator Jennifer Beck

.

The Democratic Legislature didn't vote for it because they want more funds from us. Hold onto your wallet because their greedy hands will be looking to take more. The current plan didn't have enough money to fund the deficit in the States Pension Plan.

One question needs to be answered in Trenton: Why does NJ spend 3 times more than other states for road construction?

The pension deficit will never be funded, and health care and education will be cut drastically, if Christie gets his way and cuts sales tax revenue by $1.5 BILLION yearly.

A 14% drop in sales tax revenue (a one percentage point drop from 7% to 6%) will almost certainly guarantee another drop in NJ's credit rating. Christie's sole reason for proposing that was to make himself look like the "See, I cut taxes in NJ" VP candidate.

I have a question...Where / what has been done with the additional monies from raising the registration fees on all the cars, trucks and motorcycles ??

Where is the accounting for that revenue ?

Frank,

NJ actually spends 8 times the national average on road building / repair. Some states spend less than 10 times the national average, so there is a very large disparity. I have my theories why, but I'll keep negative comments to myself. ;-)

http://www.usatoday.com/story/news/nation/2014/10/12/why-it-costs-you-2-million-a-mile-to-build-a-nj-road/17125069/

Robert

It's the end of the world JerryG. You sound like NJEA executives. Let's speak more rationally and honest, where will the money come from???

They should have taken the 1% from sales tax and put it towards the transportation fund. No net new taxes and revenue becomes a function of economic prosperity.

Until there's a audit on why we spend so much for roads, no new taxes.

The cuts are all about Christie trying to garner good PR for his VP bid. He's lame duck NJ, has been for two years.

Bridgegate.

23 cents isn't really 23 cents. I understand the bill actually calls for a percentage to be paid on each gallon. I think it may be 12.5%. That means right now we are talking 23 cents per gallon, but if gas goes up again the tax per gallon will too.

Gas at $2.99/gal would be taxed at 36 cents. Check the bill. I believe they tried to sneak this fact by us by concentrating on the current cost and potential tax.

If I am wrong, please correct me. There is probably a lot of other "sneaky" things attached to this bill too.

Transparency is the answer. Corruption occurs best when the details are hidden.

Basically, the public needs access to dashboards showing where money is being spent...

good ol' iJay...can't help but take the opportunity to comment on those bloodsucking teachers.

My point is this...no matter where the cuts are made, a $1.5 billion annual decrease in sales tax revenue will undoubtedly result in more downgrades to NJ's credit rating, on top of the eight that have already happened under Christie's stewardship.

The state of NJ is being help hostage to his political aspirations.

Here's some info on the plans.

http://www.nj.com/politics/index.ssf/2016/06/see_how_njs_competing_sales_estate_gas_tax_plans_s.html

What bothers me is the attitude of most of the lawmakers in this state. For years people have been asking for tax relief and their answer is always a tax increase. The senate democrats refused to vote for the bill because they didn't want to give up the money that the 1% tax break would give to the taxpayers. The TTF is not constitutionally dedicated. This is why they could use the money for anything they wanted in the budget. That's why it's broke. To have this money dedicated they will need to put it to the voters as a ballot question. Also, if you think all of the money will go to fix the roads and bridges, I have a bridge for sale. Call me at 1-800-gullible.

I am with you on rejecting the sales tax decrease JerryG. I am at odds with you in how to reduce and control property taxes. The truth is the truth, and the truth be on my side...

JBJSKJ is right the tax per gallon can increase to 52 cts per gallon depending on the wholesale price in the market. Also, the current TTF is funded through the general fund. No doubt the new tax will fund it the same way. What a bunch of fools they take us for and they for the most part are right. They all need to go.

"One question needs to be answered in Trenton: Why does NJ spend 3 times more than other states for road construction?"

Unions and prevailing wage. The operators on the paving boxes are making $80 an hour between wages and benefits. The guys driving the dump trucks and the guys holding the rakes are making $70 an hour, by law. I doubt there are many other states where the unions are so powerful as to create such a market.

So I just read that the senate wants to pass a newly proposed gas tax hike 25 cents per gallon over the next 3 years with no cut to sales tax. Aren't you guys glad you signed that petition to stop the original perposed bill?

It wouldn't be broke if the current gas tax was fully dedicated to fixing the roads. I believe only 60% of what is collected goes to road repair. Bend over and grab some lube.

The waste and mismanagement is mind boggling... and they want us to fund it??? geeezzz... lets repave a section of 8o again even if it is not really a priority .. and I guess the bridges that are falling down can wait.. as long as the big paving folks are kept busy and the overtime and yearly bonus, trips, pension and raises are funded... IMP.. BS in the first degree.. a nickel at most and ALL of the money MUST go to a prioritized listing of repairs ..starting with the bridges that are purportedly in terrible condition

Looks like these idiots will pass the tax and we are going to get it stuck to us again.. in the meantime no accountability and BS purchases and projects that could have been completed with existing funding or a much smaller increase... as long as the good ole boys are happy wink wink..

I don't see any property tax movement except for Christie's disastrous school plan which is a shell game and not a tax restructuring. The shell game is take all the extra money given to the poor districts, leave them with basically nothing, and reward the rich districts where the votes are. For us, even if your property taxes go down you will still pay the highest in the land and some of the highest total taxes in the land.

360 localities (townships and municipalities see reductions from $5 to $4,500 and 145 get no relief. Of the 15 screens of towns, guess what --- Warren starts on page 9 with about one township per page thereafter. Oh yeah, it's in descending monetary value.

Basically the wealthier suburbs get the relief, you get shorted, and the poorer Eastern districts get the shaft.

As I have said, without a tax restructuring to move NJ away from relying on property for funding most of it's budget, no matter what deductions you get, you will still pay the highest property tax in the land.

Basically NJ is no place to retire; everywhere else will save you money on property. Since in retirement your sales tax probably goes down, your income tax probably goes down ---- it just makes dollars and sense to get out of Dodge ---- Dodge NJ that is.

http://www.nj.com/education/2016/07/nj_property_tax_reductions_christie_school_fairnes.html

Meanwhile, I'm not sure Iman is right that NJ roads cost so much because of Unions. 32 states, including MA, are prevailing wage states kind of putting that urban myth to bed. Unions might not help in total cost but don't think they put us at a disadvantage against the 32 other states in the same boat.

The good news is since the report blasting NJ's road costs has come out, there's lots of talk, assessment, and analysis about what's wrong, both with the report and with NJ. But it's time to stop deflecting and explaining away and instead come up with some parity-based targets. While the study may have over-inflated NJ costs in the comparison, I am sure, IMO, that when computed at an apples-to-apples level, we will still suck pond water from the muddy bottom. http://watchdog.org/199387/new-jersey-expensive-roads/

First fire the DOT head who said NJ is old and complex, that's why we pay more. Idiot. MA is old and complex too. He should find the answer not deflect the question. It's was his job to know the answer before the report came out. There's no way what he said explains our cost outages here. It just defends his poor results. Second, make the study apples-to-apples taking out our debt burden for example that other states, not stupid like us, don't have, adjusting for number of extra lanes we have, short runs, utilities (not all states pay for that), and all the other stuff to get a more even comparison. Once at parity, I guarantee we still suck, but at least we can have us a target to shoot for.

It's called Best of Class thinking and NJ should do it for every aspect managed by our state government.

Then set the target, manage to the target and fire anyone who misses the target.

our tax-dollar-paid "representatives" work against us.

If we "elect" them, let's impeach them every time they screw us up, without waiting for their endless term to end (read - when they retire and "leave us in peace").

"Meanwhile, I'm not sure Iman is right that NJ roads cost so much because of Unions. 32 states, including MA, are prevailing wage states kind of putting that urban myth to bed. Unions might not help in total cost but don't think they put us at a disadvantage against the 32 other states in the same boat."

How many of those 32 states are paying a prevailing wage of $70 an hour and up for straight time? Then bear in mind every time you drive past night work that everyone you see is making over $100 an hour...

Maybe all of them. Maybe they make more. How many are making that in Nj or is that what the state pays to the company and not what the men take home. Or not.

"How many of those 32 states are paying a prevailing wage of $70 an hour and up for straight time? Then bear in mind every time you drive past night work that everyone you see is making over $100 an hour..."

False and false. I have worked a State road job (280 into Newark) and prevailing wage is $30 tops for laborer.

Point is that 32-states have Union parity with NJ. Wage parity might be a different story but chances are that amongst the 32-states, one will find comparable wages OR one can easily adjust the comparison to cover.

Overall NJ pays 12 times the national average. MA, our best comparison state being the closest in cost ( NJ pays 3 times per mile over MA. ), has a higher average wage than NJ, but just $50 a week. These are HUGE differences. Highway maintenance MA average salary --- $47,570, NJ -- $53,270. Paving equipment operators -- MA average salary $55,850, NJ -- $56,440 http://www.bls.gov/oes/current/oes_ma.htm

Point is it's a relatively easy task to look at the study and adjust to be sure it's apples-to-apples for prevailing wages or whatever to get to a parity assessment. Since there will be "theory" and estimates in that, we can argue those assessment modifications but should be able to come to an agreement or range.

Then set the target, manage to the target, and award success or fire on bad results.

I would think state employees looking to advance would jump at this opportunity to succeed. The differences are so egregious, how could you not build a stellar track record of improvement?

NJ can, and should, do this with almost any of the services we provide. Where's Christie? Oh yeah, he's busy hacking the heck out of the school budget where we are top in the nation and don't spend that much more per student than other top preforming education states. He's gutting poor school districts while throwing a nice bone to the rich and gf-ing the rest of us like Warren County. There's a rich target for success ----- NOT.

Prevailing wage is 100% theft by union sanctioned by government. Collusion between those two entities eliminates real competition and does nothing except drive the costs up of the services falling under that umbrella.

That's a fact. Spin it however you'd like and toss around whatever justifications that please you, but *forcing* wages at a certain level (higher than what would be competitively dictated) is without question a punctuation mark on the disfunction of governments abusing their powers of taxation (aka redistribution) to steal from the populous to give to a chosen few.

Sickening.

"Prevailing wage is 100% theft by union sanctioned by government." In 1867, my forefathers worked for slave wages making your steel in this heat slaving next to the forges, no AC, and you DARE to say when they unionized that they were thieves? We fought, we died to create the Union and you dare to call us thieves?

However, I didn't spin it and I didn't justify it. That's on you. You apparently judged me for taking sides when that had absolutely nothing to do with the discussion we were having. That's the beauty of doing parity comparisons, you just have to make the comparison bet at parity, you don't have to judge it as good or bad as you seem so fond of doing as of late. That part comes with the final assessment of whether you are best of class. And if Unionization is what causes it, then you can take action.

But even there, you are just plain wrong. And since you opened up the thought, Right to Work does what it says: more people working.

- Unions get weaker, wages get lowered

- More businesses enter the market, business economy rises, people employed

- Workers make less than prevailing wage, the only safeguard is minimum wage law

- When there are economic gains, those gains turn into owner profits, not worker's

- There is little support for additional worker safety nets, the power is with the owners

- When there is an economic downturn, RTW workers feel it first, and longer.

Sure, Unions can get out of hand, broker too-excellent deals for their workers. But simply saying it only drives up cost is naïve. The additional wages earned by Union workers can be good for the economy too, a rising tide lifting all boats. Union Workers can enjoy a middle class life rather than a minimum wage life. It's a bit more complex than you simplistic analysis and the overall economic effect is not just a matter of prevailing wage or right to work --- that's only a portion of the economic equation.

Wow, greedy much? I'm talking about modern day *gifting* of higher, non-competitive wages through union strong-arming (or just plain old bleeding hearts who don't care to understand where the money comes from) of government officials who then forcefully take the finds from the public. I'm NOT talking about businesses using slave labor to make a profit.

Think about my position and reply once you've calmed down and really thought about what you're saying. Greed isn't just for the wealthy you know.

Just a heads up. There is a prediction that gas prices will soon rise temporarily in NJ due to an oil line rupture. It hit sooner than expected in NC. My son had to go on a gasoline station hunt yesterday. Even large chains like SHEETZ were out of gas. Might be due to a Sandy-like panic. Might be due to no gas deliveries.

A pipeline isn't broken? They showed pictures of crews working on a pipeline on the news.

Read about it in passing a couple days ago, never followed up but believed it to be true

Speculative price increases....just like the stock markets...now another area for the shell games to raise the prices on us.

They've been talking about this for almost a week. From what I heard, the pipeline rupture occurred in Alabama and will impact the southeast more than us. South Carolina and Georgia are expected to be most impacted. Also, "unbranded" retailers like Sheetz (or Quick Chek) will feel the pinch before Shell and Exxon stations do.

"They showed pictures of crews working on a pipeline on the news."

Then it MUST be true. LOL

Christie just signed the 23 cent increase in the gas tax effective January 1st. Happy New Year.

Couple bucks a week for the average driver. Eliminates the ridiculous estate tax. Reduces taxes on retirement income. Fine with it.

Our roads suck, the transportation fund was bankrupt, we have the lowest gas tax in the land, national average is about $.30, and you have to go to South Carolina or Tennessee to get below $.23. So the tax hike is needed, is competitive, and let's fix some roads for less money than we pay today (a bigger problem in my account book.)

Meanwhile the NJ tax structure is broken, uncompetitive amongst the states and unable to pay down our debt much less provide us the services we need. Retirees can lower their property tax by a giant amount just by moving across a river ---- pick a river..... Don't matter which one. Want more --- hop a couple states away and you're in the money ---- lot's of it.

As a retiree I can go to almost any state in the land and escape estate tax; only in NJ can I continue to pay in retirement the highest property taxes amongst all 50 of the states and DC.

Add on top that we pay way to much for services we get, compared to other states, and we have HUGE problems right here in toxic waste dump city with debt and an aging infrastructure........

And so the compromise grab bag that was the great gas tax hike shows the stupidity of our legislators and governor alike in patching a leaky boat without fixing the underlying problem that's sinking us. Estate taxes went by the wayside (may take a couple years in a graduated fashion), the earned income tax level moved to the Federal level, retiree income tax thresholds moved from $20K to $200K --- graduated in over five years, a veteran tax exemption was enacted. Maybe these were good individual things. But we have a huge debt and this latest package of tax reductions will cost us $1.8B in tax revenue. So the gas hike compromise was really a tax cut without an equivalent cut in budget. That will come, probably at the cost of paying down the debt.

The real proof of what bozo's our legislators and their leader --- the fat stupid man that works for Trump now but gets paid by NJ, are the blithering idiot thing that they did to the sales tax: "While Christie wanted a 1 percentage point reduction in the sales tax, from 7 percent to 6 percent, the rollback in the final plan is a small, 0.375 percent. It will decrease from 7 percent to 6.875 percent on Jan. 1, and then from 6.875 percent to 6.625 percent on Jan. 1, 2018." NJ.com

I don't know about you, but I will be using 7% and 6.5% for my estimates and the. 875, .625 alone is proof to me what idiots these lawmakers really are. Idiots for suggesting it and idiots for accepting it.

Average sales tax is 8.5%. Our 7% tax was not egregious amongst the states. Texas, without an income tax, charges 8.15% for example. Our property tax is the highest in the country. New York laughs at us. CT proves we are property tax stupid. PA takes our tax refugees looking for a better life in the promised land while continuing to work in NJ.

Our debt is the second highest in the country (debt/gsp) so we are lowering our tax rate. Our property tax is the highest in the country so we lowered our sales tax rate and relieved retires from income tax (when most are retired from income to begin with.....). Our costs for services are the highest in the land so we are lowering our tax rate instead of drilling down to determine why we pay more to get the same thing done and fixing that. We just bankrupted the transportation fund so we lowered our tax rate so we can bankrupt the state. While fixing the transportation fund, this compromise will mean $1.8B less in tax revenue to fix those problems of debt and services while doing little to stem our retiree exodus due to property taxes.

Idiots on both sides of the aisle and especially at the head of the state.

But I am not bitter :>)

I think the gas tax goes up as soon as they sign the bill, but the sales tax doesn't go down until Jan 1 to 6.875 percent. Then in 2018 it goes down all the way to 6.625 percent. That is if they don't change it again before then.

Will we notice the sales tax reduction? Only at the state tax revenue level.

Cutting public sector retiree health benefits is the answer SD. There is no protection to stop this except for the Democrats in Trenton. Retirees 65 and older are minimal with just paying Medigap, but retirees under 65 cost about $25k per year for the average retiree with a family; this is something the taxpayers can no longer afford.

So you see SD, only with harsh changes will there be change. Will this happen? I say yes eventually...

"Couple bucks a week for the average driver. Eliminates the ridiculous estate tax. Reduces taxes on retirement income. Fine with it."

http://www.wsj.com/articles/states-siphon-gas-tax-for-other-uses-1405558382

(if you can't read the article paste that into a Google search and read the article from the google link)

From this NYT article:

"New Jersey is projected to collect $541 million in state gas-tax revenue this year, of which $516 million has been set aside to pay for about $1 billion in debt interest. "

Guess you're OK with paying more today to deal with the malfeasance of past generations, because that's the reality. The funds today are NOT going toward what you think they are, some of the money is being diverted for other purposes (if the above link is to be believed quite a bit more). And guess what? The more debt we have the more this shell game will continue. No big surprise there.

Common theme once again... we're paying more today for the debt-based idiocy of the past. And of course all of us today just want to do the same to our children. Aren't we just so nice...

Whether or not the gas tax goes to roads is on this years ballot so its up to you.

Funny how they can get certain things on the ballot at this late in the ballgame and most other times they say they don't have enough time. I guess it won't be on the absentee ballots as those have been printed already. That being said everyone should vote YES.

I'm glad so many folks have a big estate inheritance coming their way. I don't have any of that so yeah, the gas tax sucks. I'm also about 25 years away from retirement so yeah, f the retirement income tax break too.

Notice the word "projects" Old Gent. The word project can mean anything they feel fit to do with the money. I don't trust them. What guarantee do we have that money will be spent specifically on road repairs, crumbling bridges, etc. None!! The way it's worded most people will think "oh goody they will fix the roads" and vote yes. Wrong!! It's a crock and we are getting the shaft as usual. Nothing will change. The gangsters in Trenton will just say "sorry you voted for it" and we still won't have anything to show for it, Trenton's gangsters have mismanaged our money for decades, giving them more to squander is foolish imo. I'm voting no.

It says the entire tax, by constitutional amendment, goes to the transportation trust fund. Now the yucks don't have to think about that decision anymore; we can phone that decision in.

Usually I would be against constitutional earmarking for spending in lieu of making the individuals paid to be responsible for budget decisions.....responsible. It leaves them off the hook for managing the job we pay them for.

But these incompetent yucks deserve it so I am voting yes.

auntiel, It goes to bus and trains also, just the the drivers are paying for The shippers will pass it down in there billing so everything goes up, and we all pay.

School bus transportation expense will go up, so our property taxes. And price for all other municipal, county, state expenses that involve gas usage (SNOW REMOVAL, police, fire department, EMT, etc) will go up, so our property taxes. All deliveries and farming will be more expensive. The ones who use landscape service, will pay more next year. And they definitely will pay more this winter for snow removal.

Are there exact numbers for the reductions in pension income and for the veterans?

Lena, PA will have about 10 cents per gallon higher prices. I hear everyone about passing on the costs; just that PA has been doing it for some time...

iJay - I am not really concerned about the gas price in PA as long as it's lower than in NJ (and long haul truckers and commuters will fill their tanks in NJ). I just know that gas hike here in NJ will trigger the price off all services paid thru our property taxes to go up. There is no other choice to balance budget but increase our property taxes accordingly to gas hike next year. I am sure that in February-March we will face the situation when there are no money for snow removal left because budget was created using old gas price. And of course if you commute to work by bus you will pay more for tickets. More people will move from our area closer to the city and sell their houses. Of course it will be good for not using roads but bad for our local economy.

If gas is at about $2 now it is just under 10% increase and probably 10% as we approach Winter. We are talking about 10% increase in fuel which is not all the raw costs by any means. The drivers and maintenance on snow removal machinery is much higher.

Yes, services will go up but it is no catastrophic. You should be more concerned with the costs of cadillac and even non-cadillac health plans rising year after year; and of course the overcompensation of public workers whose pension system is a time bomb.

As mentioned before, cutting public workers retiree medical will save a lot of money, this gas tax is chump change. The average public retiree with a family under 65 costs 25k per year...

If the money was spent wisely I would not have an issue. We own small business on Rt#46...we often get to witness highway workers "working" outside our shop due to an ongoing drainage issue that has yet to be resolved. What we see is 2 or 3 people physically working and 2, 3 or 4 supervising. What I Know if that If we ran our business that way we would have been out of business years ago. Over manning requirements imposed by unions of supervisors, overseeing supervisors certainly add cost and is reflective in NJ's having close to the highest cost per mile in the nation.

Is is such an alien concept to expect public services to run with private efficiencies? I know it is, but will the mindset EVER change...

What a waste of money.. there is NO WAY this kind of hike should be justified.. A small increase of 10 cents or less MAYBE. Make me sick to think I am gong to have to pay this to support non productive workers, crony appointees. repaving of roads that don't need it and funding dippy projects that should not even be in the budget.. PLEASE call Trenton Monday and raise holy you know with these politician.. Enough!

+1 to this:

"What a waste of money.. there is NO WAY this kind of hike should be justified.. A small increase of 10 cents or less MAYBE. Make me sick to think I am gong to have to pay this to support non productive workers, crony appointees. repaving of roads that don't need it and funding dippy projects that should not even be in the budget.. PLEASE call Trenton Monday and raise holy you know with these politician.. Enough!"

well said Enough, couldn't agree more,

Another $4.5 million hit to NJ taxpayers thanks to the corruption in the Christie regime... $3M in legal fees and a $1.5M payoff to a former prosecutor turned schoolteacher.

http://www.lehighvalleylive.com/hunterdon-county/index.ssf/2016/10/ex-hunterdon_co_prosecutor_get.html#incart_river_home

There's two sides of this; the tax side and the spending side.

On the tax side, and I think with all taxes combined, percentage-wise we have the third highest taxes in the land. However, there's about a dozen states within 20% of us, we not alone. Also have to bear in mind that taxes are progressive and NJ has the 5th highest income per capita as well so our tax percentage will be higher since we have richer citizens. Our tax burden is 12.2% and our income per capita is $56,731.

Compare that with the place we should all be moving to: Wyoming. Tax burden of 7.1% and income per capita of $57,179. Mining, energy and tourism so chances are they have been hit by the oil price drop but....... Since we were talking about it on the other thread, South Carolina is 8.4% and $34,820 so great place if you have an above average paying job.

So on the tax side, we make a lot, we pay a lot, we are at the top, we are not totally alone but obviously could be doing better. Kind of a cool assessment: http://taxfoundation.org/article/state-and-local-tax-burdens-1977-2012 If you extract to spreadsheet you can sort. Good tool for starting retirement move but I warn you, you have to look that the tax factors that affect you. For example, getting a smaller house, dropping to one car might relieve some burdensome SC taxes that show up in the averages. Even in NJ, if you get a tiny house on a postcard plot in a poor neighborhood, you might avoid property tax which is close to 50% of your tax burden (just saying). And taxes are just part of it. Wyoming might be great, but the winters, oil wells, open pit mining and fracking might make you reconsider. Teton County tourist areas might be nice though.....

On the spending side ---- NJ often sucks and with gusto. To me the answer is the f-word. Three of them: find, fix or fire. That is, find the parity metric for comparison from other states or both private/public sectors. Then set a target for fixing NJ spending costs. Promote, retain or fire based on success in meeting the metric.

The first part is the tough one - setting the target: lots of facts, debates, screaming and spin to arrive at an agreeable competitive parity comparison (or compromise --- don't matter). Gonna be a number of estimates and models to fight about. Need input by the public and the press. Set a time frame to finish study and march to the schedule. Fire if agreement can't be had at the scheduled date. It's their job.

Once the target is set, the rest is implementation. Can't reach the costs with instate contractors, just trying hiring the contractors from states that hit the target. I am sure they can figure it out. And then measure to the target metric taking appropriate actions based on results. Some examples.....

Road costs triple even the most states, ten times many. My goodness, how hard can it be to succeed here? We could set a weak target and still save a bunch. I want this job, can't fail.

Pension --- actually here NJ is modest compared to other states in what we offer to pay but is that the metric? About 30% of major companies offer pension, many of the one's not offering use plans like 401K. So the question would be does state pension parity only include other states or the entire pension-capable offering universe. I say the latter. But find the answer, set the target, and measure the result.

The second pension issue is payments to existing retirees. To reduce that load, the easiest way is to offer buy-out plans. Get em off the books for less than the total payment. Like a reverse mortgage, can be good for some. Many states looking at this, not sure if any have offered. But it's the only way to take the short term hit but lower the long turn hit and recurring cash flow loss.

OK, health coverage --- On total expense: NJ pays much more than any other state. http://www.nj.com/politics/index.ssf/2014/08/nj_has_one_of_the_most_expensive_state_health_benefits_plans_in_nation_new_study_says.html Again, I am not sure that a state comparison is the right one to use here and that a global look of private and public is probably more appropriate.

sorry, more coming :>(

Education: this one is interesting in that, and you might have to do this with other metrics, you really need to look at results of the money. We pay more, not the most, but a lot, but our results are stellar. So before we set the target to average, we have to ask do we want to lower the results to average. That's the business of negotiation in the "find-it" phase. My take is we might prune but not slash.

So that's a few and it only takes a second to gather enough key information to know the priority of fixing (like roads which is a no brainer of being out of whack) or whether to study longer due to complexities (like education). We can prioritize also on amount of budget: pensions, healthcare, education, etc. etc. Other areas on the budget are welfare and protection -- just use the same process to start establishing target metrics.

However it will take a lot to agree to the final number. Again, set a schedule. You can always change the target when new information presents itself.

Then get the owners to set a plan to reach target, agree, and implement and measure taking actions based on results. That's the business way to do this.

Now in saying all this, we should recognize the priority of time. If we earmark all gas tax to transportation, these people are about to get more money to spend then they have ever seen. Based on our current results, I do not think NJ citizens will even notice any benefits. If there isn't a crash program to get this spending to be more efficient, this whole thing has been a total waste of time and money.

OK, now on to solving world hunger :>)

http://nj1015.com/why-the-fairness-of-the-gas-tax-is-anything-but-jeff-does-the-math/

101.5 radio has a good take on this gas price hike........

Unfortunately the sales tax won't be 6%. In 2017 the tax will be 6.875% and then it 2018 it drops to 6.625%. Either way not much.

yesterday i bought gas in town and paid 1.85 - tonight it was 1.95.................they are not even waiting for the ink to dry - we are in trouble!! i call this gouging!!

Rush over to the new CVS they have lube on sale. God knows we are going to need it...

The recent gas price per gallon hike is the usual ups and downs based on the crude oil market. WTI (West Texas) is up to $49.15 at the end of the day for Nov 2016 delivery. When the price was going down a few weeks ago, that was the reason the prices per gallon went down a slight bit.

Either way, they (the NJ Legislature and Govenor) are taking advantage of our current price trends of the past two years of gas hovering around $2 per gallon- and sticking it to us- thinking we wont complain at paying "only" $2.25 again.

If the price was back to where it was a couple years ago, over $3 per gallon, there is no way they would be doing this right now, the outcry would be a whole lot more.

"And so the compromise grab bag that was the great gas tax hike shows the stupidity of our legislators and governor alike in patching a leaky boat without fixing the underlying problem that's sinking us." We had to save the transportation fund, and sure, we could use other existing tax revenues, but face it, they are all spent or should be used to pay down the NJ debt. So everyone in Trenton pitched in to make this a grab bag of tax cuts to shift the blame from the transportation fund hike and screw up. Essentially this was a compromise favoring both liberal and conservative ideals based on the line item tax cut.

Maybe these were good individual things for different liberal and conservative advocates and constituency. "But we have a huge debt and this latest package of tax reductions will cost us $1.8B in tax revenue." That's the bottom line.

We had to remove the estate tax to remain competitive with other states for retaining retirees but it will do almost nothing to stem the exodus which affects all of our home values and our quality of life so its a stupid half solution (and I will be one paying it, God willing and the creek don't rise) Why? Because this doesn't affect the tax structure which relies mostly on property tax which affects the retired much more than the working. We get almost 50% of our revenue from property. That's around 33% higher than average states all meaning you can't help but make money at retirement by leaving the state. You have a 4% chance of paying estate tax, 100% chance of paying property tax. As a retiree, your income (and income tax) drops but your state tax remains high because of property tax. We have the highest state property tax rates in the land. So we will be leaving as soon as we retire independent of the estate tax rollback.

That's on the tax side where NJ's tax structure is broken and not competitive with other states. The retirees will continue to flee the state in record numbers.

On the spending side, see my overly long tome above but bottom line is we suck. We need to make our spending more efficient and effective and it's not that hard. Especially in cases like roads which is so egregiously bad that anyone can do better.

While our total tax rate is too high, we are second, not first and have plenty of company just below us. IMO, this is a problem but given our debt, even if we spent less, I would not tax less, I would pay down the debt. Given that, we have a HUGE problem in tax structure resulting in losing our retirees and their assets. And a HUGER problem in spending money effectively. Those two areas --- structure and spending effectiveness is where we should be holding our legislators feet to the fire and removing them if no action is taken ------- soon.

Got this from Jen Beck this morning, please sign the petition and send this tweetand like it it on fqacebook ( i belive it's trending righth now, keep up the activity on it) please share this with your friends and family, contact your legislators :

-------------------------------------------------------------------------------

They’re Trying to Fast Track a Gas Tax Increase on Wednesday!

Like This on Facebook Tweet This

We need your help to stop it.

On Friday, the Governor, Senate President and Assembly Speaker announced a deal to enact a recycled version of the old plan to raise the gas tax by 23 cents/gallon.

The Senate President just scheduled a Senate session on Wednesday — only two days from now — to fast track a vote on their $2 billion gas tax increase.

The people of New Jersey have made it clear that they reject this massive tax increase.

That’s why I fought against it last time, and will fight against it again.

Please know that your support was critical in helping us to stop the gas tax from advancing in June.

More than 12,000 people signed our online petition, and thousands more showed up at rallies, called and sent emails.

Now they’re trying to rush a vote and limit public debate on their newest gas tax proposal.

They don’t want a repeat of the public outrage they received the last time around. Let’s make sure they don’t get away with it!

Here’s 3 things you can do to help:

Sign the petition and share this link on Facebook and Twitter:

http://www.senatenj.com/nogastax

Contact your legislator. Forward this email to family, friends and co-workers.

Unless you act, the gas tax will happen. Help me to stop it!

let your legislators know. write them, send emails and call their offices. Here's how to find your reps:

http://www.njleg.state.nj.us/selectmun.asp

i urge you strongly to support other candidates every election cycle till we change the face of the NJ assembly and the NJ senate.

Bozo the clown? See, little difference between "Creepy Clowns" and politicians.

When I was a kid Bozo featured in more than one of my nightmares. And now, with that puffy red hair Bozo had, he does remind me of someone running for office...

You all realize that Wednesday is "today" and not "two days from now", right? They're probably already in session.

Senator Ray Lesniak is leading the charge against Chris Christie's gas tax. Please go to his FB page and his website..he explains it there..sign the petition..

Which Assemblyman/Senator from Warren County is voting for this tax increase?

yeah i forwarded what i got, today is the day, all the more reason to act right now, Ian; did you contact your reps? sign the petition? please froward this to your contacts asap, thx

I faxed and called my District 24 legislators (my legislators for Liberty Twsp where I live) before 9am today. While I do not think it will help- I cannot sit on the sidelines without some form of protest.

If they vote YES to the tax or abstain to vote, I will in no way reelect them next time their terms are up.

I won't forget!

You can't win this, the tax deal is done. You're tilting windmills given the transportation fund is bankrupt, NJ pays less gas tax than everyone, and the vote have passed with support on both sides of the aisle.

If you cancel the gas tax hike, how do you plan to solve the transportation fund while providing other services and servicing the debt?

IMO better to vote yes on the ballet to constitutionally earmark the tax to transportation. That will put their feet to the fire on the other items by removing the transportation fund from covering other spending. JIT shows they are doing that...a lot...although I have seen other facts that says it's less, but no matter what, some transportation fund money is being siphoned (like that?) to pay for other things. So if we earmark, that means either raise taxes, remove services (don't think they will do that), get more efficient or some of each.

Meanwhile, if the earmark vote passes, and I am betting it will, the transportation department will have more money than ever so we better scrutinize their performance since today, it sucks, and I see no improvement plan in place. To me, that's where you need the petitions. Get these guys to have a cost improvement plan OR continue to pay the highest price in the land ----- now with a lot more money to play with.

pampurr - Steve Oroho from sparta is a big supporter of this, contact his office and tell him no way jose' on this gas tax

I will gladly pay the additional $0.23 per gallon for better roads and bridges as long as the funds are mandated to go to that purpose and no other. I have contacted my representatives and told them this and no, I didn't sign the petition just like the 8 million other New Jerseyans who didn't... versus 12,000 who did.

if you were listening to 101.5 this morning you would have learned that if this gas hike goes into effect there is a good chance there will be an additional gas hike (already written into the bill) that will take affect in the future......everyone should sign the petition!!

strangerdanger, I will NEVER vote yes on the ballet... or the opera, or those godawful musical theater productions.

I believe a lot of the tax increase will be used to on the Hudson Light Rail Project and a light rail project in South Jersey. Also, they are expecting a 15 dollar increase in the price of crude due to the reductions made by OPEC recently. Others already reported a 10 ct. increase per gallon yesterday at the pumps.

I dunno. In my yout, i saw barishnocough. It was great. There was a young lady involved but......

Every politician in NJ that supports this "disastrous" gas tax increase to use Trump's words.. needs to go..period... We need new leadership here.

....While your at it..Impeach Christie for Bridgegate and all his other low down antics he threw at the tax payers.

Looks like the vote is now pushed back until Friday- 2 more days to make them think about their own re-elections.

http://www.nj.com/politics/index.ssf/2016/10/23-cent_gas_tax_deal_may_be_stalled_in_legislature.html#incart_river_home

The bill includes, "the tax on non-motor fuels will rise from 2.74 percent to 7 percent." Does this mean home heating oil? Or what does it apply to?

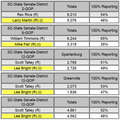

How our assemblymen voted: http://nj1015.com/gas-tax-a-done-deal-how-every-member-of-the-assembly-voted/

How our senators voted: http://nj1015.com/senate-oks-23-cent-gas-tax-hike-how-every-single-member-voted/

Now we need to remember them when November rolls around---good or bad.

Hey, if you don't like it, move to another state.

Oh wait, even after 23 cents, you will still pay more tax :>)

10/7 --- always remember.

Gas tax bill is signed. Gas lines form Oct 31.

Will roads get better? Let's see, every month you pay towards the 911 cell phone project. Google how much of your forced, collected tax has gone towards that. Funds for the project that would have prevented the Hoboken train crash were mispent. Now the Feds might take over to force that spend. I hope they do.

Vote next month. Vote to allow the amendment to force our untrustworthy leaders to spend the gas tax on roads and bridges. Just can't trust them.

It's sad that an amendment is even suggested, for that screams from the rooftops that our legislators have zero restraint.

The ammendment won't solve a thing if we don't also change mindsets. There's plenty of other tax money floating around to manipulate, so all this will do is shift the problem elsewhere. Still the same old shell game.

"Gas tax bill is signed. Gas lines form Oct 31."

How long are you willing to wait in line to save $3? I would make a lot more money if I spent the same amount of time working rather than waiting...

"The ammendment won't solve a thing if we don't also change mindsets. There's plenty of other tax money floating around to manipulate, so all this will do is shift the problem elsewhere."

It should solve the problem of not having a dedicated source of funding for road and bridge repair projects, which is all that it intended to solve. I agree with you about the waste elsewhere, but that's a different issue.

"It's sad that an amendment is even suggested, for that screams from the rooftops that our legislators have zero restraint."

I saw thousands and thousands of Muslims cheering from the rooftops in Jersey City. Guess they think they will share in the new profits :>)

SD there were not thousands of Muslims cheering but there were a few Israeli Mossad agents cheering for our entrance into getting our faces shi!!ed on by Islamic terrorists...

Vote each and every one of them out next election by making a list of all those who failed to stop this gas tax.

"Vote each and every one of them out next election by making a list of all those who failed to stop this gas tax."

This ^

This is small change stuff. System wide overcompensation and corruption in the public sector must be addressed to obtain real results to make NJ affordable. Of course doing this takes money out of some people's pockets; whether or not this is correct (which I believe so) it will be strongly fought by the unions...

iJay - I agree with most that you post regarding public workers, but my question is.....why are you still here in NJ? Just curious. Thanks for your reply.

Various reasons - family, job, other. I do have a place "to the south" already which I get to often. I could move quite quickly, but just not yet as the job prospects in the immediate area are not good for professionals. Give me a "few more years" which could end up being a decade more in NJ...

The only "winners" will be those legislators that get my vote due to their support of not voting Yes on the gas tax. So long Senator Oroho, you will never get another vote from me, you failed the public on something that affects all of us every day and voted to give us negligible tax reductions in return.

(Even if I have to vote against party lines, he will not get my vote). We are stuck with him another couple years, I won't forget!

Not so negligible a tax reduction for this family:

http://www.wsj.com/articles/phasing-out-a-tax-saving-the-family-farm-1476237258

For the small percentage that are helped- vs the large percentage that are hurt- doesnt change my mind.

How about the large pct of people that benefit from better roads and infrastructure?

Sorry if I'm not crying because of $2-3$ a week for the average commuter. If it saves me a $700 front end job, I'm glad to pay it. If our bridges and tunnels get repaired properly, then it is money well spent and will improve the NJ economy.

So short sighted.

I have driven my car for 30+ years on NJ roads all over- and have never had to have a "$700" front end job. Either drive a bit more carefully, more observantly or find another shop! (and I say this with a friendly smile, not in anger).

Fix the waste in our govt- which will never happen- or let program funding run dry- which will then cause govt to start running their departments like a business, and actually use any money they are given by the public taxpayers responsibly. (will never happen, of course)

"For the small percentage that are helped- vs the large percentage that are hurt- doesnt change my mind."

I think everyone who drives over NJ's roads and bridges are helped by this tax increase. Those who drive more will be helped more, and will appropriately pay more. And those who don't use the roads and bridges, aren't directly affected.

What could be more equitable than that? Do you propose that we stop doing road and bridge maintenance? Because that's where we were...

Two years ago hit a pothole that popped a tire and dented the rocker panel. Hard to see in 60mph traffic.

If you want to take action, vote yes on the earmark ballot issue to dedicate the entire gas tax to transportation.

Then the real trick is to get them to spend it wisely. Especially since we spend ten times other states on a per mile repair basis.

All I hear out of TRA is 'me me me'. Just because you've never had a front end job (which is just one example) we shouldn't fix the roads? For the record, I haven't either, but if the roads continue in the state they're in, it's inevitable. How about a blown tire? Cracked windshield? Bent rim?

How about the toll it takes on our economy? Wait until one of the Hudson River Rail tunnels closes. It will make a severe dent. And our gas will still be cheaper than PA or NY.

And I agree that waste should be reduced, but guess what? Ain't happening. So at least fix the roads with a dedicated tax.

The average working person should be thinking exactly that- "me"- the tax burden in NJ falls on the middle class. Maybe your not in that class "MeisterNJ", maybe your above or below it. But any tax that falls and lands on the middle classes lap, to affect them directly ever day, yes I am against.

NJ prior to this tax being enacted was already onerous in their real estate taxes, cost of car insurance and general cost of living here. Yet, I would rather live no other place. But, with less and less money in MY pocket, yes me (the middle class), there will come a day that I will have to think it though.

That day is closer now with more burden on me- and I speak for that large group of people called the middle class worker. They are "me".

Is there a separate 'middle class' pump coming on Nov 1 that I'm not aware of? Or there's no need because only the middle class uses our roads? I'm confused.

"And I agree that waste should be reduced, but guess what? Ain't happening. So at least fix the roads with a dedicated tax"

I disagree. If the problem is legislators not doing their jobs it won't be fixed with this distraction. If anything this is a confirmation that funds are never really allocated as promised and that we should expect the shell game to continue, now validated as being ok.

The answer is to vote legislators out of office. Fat chance of that with the duopoly mindset

Lets not fix the problem by curtailing wasteful spending, lets add yet another tax and fix the roads.

Less than 1/2 % sales tax cut which means when you spend a dollar you still pay 7 cents sales tax.

btw, if someone can find it there's a link stating that the majority of the current road tax is used just to pay the interest on previous loans, the implication being that the tax would be fine if it were used as it is supposed to be used. Sooooo, what about the getting into debt thing? How will that be helped with a dedicated tax? It won't, and so is this dedicated tax thing nothing more than an appeasement action because the money will go to *both* the roads and the previous borrowed costs for them? If history is any indicator, this is just more of the same shell game.

Dougherty will sign as co-sponsor on legislation to repeal gas tax.

http://www.senatenj.com/index.php/doherty/doherty-joining-as-sponsor-of-bill-to-repeal-the-gas-tax-hike/29681

"If it saves me a $700 front end job, I'm glad to pay it."

This is a defeatist mentality, makes me question that you are part of the public sector employment...

Thank you for the link Calico, I have signed that petition.

Leaders like Sen Mike Doherty and Sen Kip Bateman are at least listening to the masses of NJ residents that disagree with this tax.

The ballot question is a constitutional amendment. So if that passes, good luck on repeal.

Where is the money coming from to fix the roads? The gas tax increase will raise about 1.23 billion per year. Cut retiree medical for state workers and that would save about 1.4 billion in 2014...

How in the flying fig is this gas tax union related?! iJay, you are one tedious... Manners prevent me from continuing.

Is that the same Mike Doherty who condemned Kim Guadagno for "abandoning" Donald Trump? F him and the horse he rode in on, lol.

Plus, you all know damn well that Doherty knows there's no way this tax is getting repealed. Pure political pandering, plain and simple. But feel free to fall for it if you feel like it.

I'm about as far from public sector as can be iJay. And no iJay, it's pure math. $150 is less than $700. Heck, it's less than one tire.

WHY not cut retiree medical benefits? It largely does not exist in the private sector. As Christie says, why are the have-nots paying for those who have? WHY is this topic off the table?

The Bishop, savings could be applied to road repairs (and more) so the gas tax would not have to be raised, understand?

from calicos link:

“I fought against the gas tax increase every step through the legislative process, and I’ll continue fighting against it now that’s it been signed into law,” said Doherty. “We’re not spending the gas taxes we already collect wisely, so it’s not fair to ask drivers to pay more.”

Doherty has long called for a study to examine excessive state transportation costs. He is the sponsor of S-1888, which would create the “State Transportation Cost Analysis Task Force.”

A new petition to repeal the gas tax increase has been signed more than 7,500 times since it was launched Friday evening.

“From the calls and emails I’m getting, I know my constituents are outraged by the gas tax increase,” added Doherty. “They don’t know how they’re going to pay for it, and they shouldn’t have to.”

The petition in support of the legislation to repeal the gas tax increase can be signed at senatenj.com/gastaxrepeal.

OK..... we is veering off course here, but my sum.

- gas tax is still one of the lower in the land; dedicate it to transpo and work the efficiencies where we suck so bad impossible to believe we could not improve.

- second highest overall taxes in the land and structure is all wrong focusing on property as main revenue source screwing retirees unfairly after they stop working. You just have to move, financially speaking. So, change structure however even though we are second, we have lots of company right below us. So I would focus on cost, not overall rate. And if we spin cash, pay off the staggering debt.

- Agree with Ijay on retiree medical benefits. As well as structuring going forward pensions and benefits to be commensurate with the private sector. Wages are close enough, so why not bene's

- Leave schools alone for budget, we are number one.

- Offer buy outs to pensioners, it's a win, win, those needing it get cash, we get them off the books.

- To work the costs, implement find, fix or fire. Set competitive cost targets based on other states or like targets, target the big cost hitters and outages like roads (we pay 10 times other states per mile of repair), health benefits (we pay more than most states), and the like. But make it a process, an visible, transparent process that starts with assessing our cost structure on a competitive basis and setting targets. The rest is turning the crank to fix --- do well and be rewarded, do poorly and be gone.

Use savings to pay off debt. Once at reasonable level, lower taxes.

You know, iJay, you're a hoot. You expect everyone (but you, of course) to work for slave wages and give away their future security, not because *they* did anything wrong, but because the state screwed up and doesn't know how to budget anything without all the cronyisim?

Do you have any actual experience in what it's like to be a public worker, or to negotiate a contract when the people on the other side of the table have a whole lot more money and lawyers and money than you do? You keep blathering on about how 'unions are all powerful' but you have *zero* actual knowledge or experience in what you're yammering about.

If we were 'all powerful' then I wouldn't have taken a $12.5k pay cut when the governor put his pudgy fingers in *my* pocket.

What's extra funny is now that he's got his fingers in *your* wallet, you find some convoluted way to blame the folks who keep you safe. Why the *hell* should I sacrifice *my* retirement because the *state* screwed up and underfunded the transportation fund? I don't see a connection! Maybe they should seize all your assets to pay for it? It would be just as fair!

"Why the *hell* should I sacrifice *my* retirement"

Why should *I* (as a taxpayer) have to guarantee funding for *your* rigged retirement?

In short here is what happened (but I know you don't want to hear the truth):

1) Teachers were once underpaid

2) Then the unions negotiated. Knowing they could not get large salary increases they "negotiated" with the democratically controlled legislature to get high total compensation, specifically with generous pensions, generous medical plans while employed and retired.

3) Since the "sale" of this plan required little money initially, they (unions) knew the adequate amount of money would not be set aside every year, which is why they added legislation that the state has to fund any shortfall (which Christie fought arguing that this legislation cannot force us to borrow money to put money aside).