How long do we have? (Re: US Debt)

Recently i started learning how bad the US national debt actually is, and learned that the amount of debt we have can never be paid back, EVER. Over $17.5 TRILLION

Recently many countries that use USD have been selling/trading/getting rid of them.

They know the USD will soon be worth nothing. And our Government knows it too. They are preparing for when the Dollar collapses not if. remember when homeland security and the national guard bought a metric shiton of ammo? and a lot of people were like wtf is it for?its the government preparing for mass chaos, looting, rioting, Murders, they are ready for when it happens. Obama even made it so he can declare Martial law on his own. If the money you just got yesterday from working 80 hours turned into something as useless as the lint in your pocket, and you cant buy anything, you cant feed your family, how do you think you would react, how do you think every other american would react, Why do you think they are getting rid of our guns...

http://www.usdebtclock.org/

Please keep the useless and troll comments off the page, not helpful.

I have read that the global economy might soon reject the dollar as standard global currency. Not sure what they might choose instead.. yen, euro? But if/when it happens it will mean that everything we buy will cost much more, there will be a currency conversion cost added.

This came from Stanberry and Associates, of course they were trying to sell their financial newsletter, it may have been a scare tactic.

We'll just keep printing money. The USD is nothing but a number. It's meaning is useless information. It's just keeps people like yourself in panic mode. Relax, have a beer and stop creating trouble.

DH -- get some real facts.

For example, the debt, as viewed as a percentage of GDP, was worse post WWII, paid down in 35-years, and did not start building again until Ronald Reagan added debt to build bombs to tear down that wall. And then the debt bunny kept going and going and going until Clinton, and then kept going and going.

Since the great recession stimulus we have been slowing the rise and could put a real dent in it if we just rolled back the Bush tax cuts. Our taxation levels are incredibly low, the lowest in a number of decades. That's decades. At least 40 years. Of course then the trick is to actually buy down the debt with the proceeds but we could always earmark the Bush cut reversal to do that for a couple of decades.

A second element is revenue but that means jobs, jobs, jobs, something that NJ's Christie has been really bad at.

On the world moving away from the dollar, you gotta ask yourself first: where are they going to go? The Euro, nbl. The Yen, well, China invests heavily in dollars as you well know so...... Or try this: http://www.forbes.com/sites/billconerly/2013/10/25/future-of-the-dollar-as-world-reserve-currency/

Periodically this doomsday scenario finds new life...it shouldn't!

It is based on a projection of a debt to GDP ratio of 199 by the year 2037 which clearly is unsustainable for any nation. However it assumes that following the year 2022 there will be a fixed amount of revenue (not taking into account improvements in production, technology or dare we say it, tax increases) while all spending including entitlement programs will skyrocket (however already we are seeing significant reductions in annual health care costs). Economically and politically this scenario will not take place...both the Republican and the Democratic Party have a vested interest in maintaining a more sensible equilibrium whether that means adjustments to pension funds, Social Security, Medicare or any other aspect of the federal budget.

The most recent projections by independent, private economists sees a debt to GDP ratio of about 97 in the year 2037. Is that optimal? No but it is far from the disaster outlined.

The stockpiling of weapons and the martial declaration comments have been thoroughly debunked so many times before including on this site, I believe, that they are no longer worthy of serious comment.

Our nation, along with Germany, has been in the forefront of the rebound from the Great Recession of 2007-2009. Today we talk about rates of economic growth while other nations are still retracting...we do indeed have problems and excessive spending is not to be taken casually but America is poised to continue to be among the strongest economies in the world for many years to come.

Run for the hills! Stock up on ammo and bottled water.

Actually, our debt to GDP ratio falls in line or below other developed countries. Is it high? Yes. But it's no worse than Germany, England, France. And much better than Japan. I'm not worried about impending doom.

http://www.pfnewsletter.com/glp/35118/EndofAmerica.html

load up on Krugerrands, canned goods, seed catalogs and shotgun shells, and head for a log cabin in Idaho :)

"Please keep the useless and troll comments off the page, not helpful."

Too late! Immaturity knows no age boundaries.

negative interest rates coming here soon?

ECU (European Central Bank) announces negative interest rates will be imposed:

The interest rate on the deposit facility will be decreased by 10 basis points to -0.10%, with effect from 11 June 2014. A separate press release to be published at 3.30 p.m. CET today will provide details on the implementation of the negative deposit facility rate.

PRESS RELEASE

5 June 2014 - Monetary policy decisions

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.15%, starting from the operation to be settled on 11 June 2014.

The interest rate on the marginal lending facility will be decreased by 35 basis points to 0.40%, with effect from 11 June 2014.

The interest rate on the deposit facility will be decreased by 10 basis points to -0.10%, with effect from 11 June 2014. A separate press release to be published at 3.30 p.m. CET today will provide details on the implementation of the negative deposit facility rate.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 2.30 p.m. CET today. Further monetary policy measures to enhance the functioning of the monetary policy transmission mechanism will be communicated in a press release to be published at 3.30 p.m. CET today.

http://www.ecb.europa.eu/press/pr/date/2014/html/pr140605.en.html

"DH does have the real facts"

Maybe not! The total foreign holdings of U.S. Treasuries is continuing to rise every month right up to April (the last month on the report). Source is the U.S. Treasury: http://www.treasury.gov/ticdata/Publish/mfh.txt

"Recently many countries that use USD have been selling/trading/getting rid of them."

Unless there is a reliable source of data for May that shows a steep drop then this statement (opinion) is clearly not true - they are acquiring more.

The problem here is not what people don't know. It's what they think they know but really do not.

BDog: the day we're controlled by the Euro is the day our economy has already crashed.

So we have debt. Less debt/GDP than a lot of solvent countries but still too much in my book. Not by any analytical sense but just the fact that I hate debt. Especially when the only time it has lessened since Reagan is during the Clinton years. It's not just the amount, it's the trending. Speaking of which, since the great recession and stimulus we have been reducing the slope. Still not good enough.

One thing that could instantly put a dent in it would be to remove the Bush tax cuts but put in a ten year earmark to the debt for the revenue. Currently our tax rate is the lowest in decades. Lowest average tax rate In over 40 years. Let's remove the Bush cuts and get back on track.

Second, Medicare is bleeding. Fix that. These systems are supposed to be solvent; make it so.

Third, quite monetizing the debt. I will let JIT explain that one.

No more wars like Iraq. That's $2T right there and some say $6T by the time we pay off that portion of the debt. Perhaps a "war tax" to cover Iraq and Afghanistan portions of our debt and then maybe next time people will really think twice before saving the world.

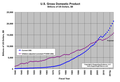

RAD, instead of looking at extremely short term changes and thinking that those minor blips on the radar are somehow significant, how about looking at the long term trends?

http://research.stlouisfed.org/fred2/series/FYGFD#

While trends can change, can you honestly look at the above graph (whose exponential curve is mirrored in a great many other data points concerning our economy - peruse the monetary section of that site for a while if you care) and not think that intelligent people should extrapolate based on our 80-year behavior? And if you are not concerned, does the fact that doubling time reduces much more quickly the farther out an exponential curve you go? Download that data into excel and take a look. A man of your knowledge should be able to perform the calculations quite handily.

Eh, it doesn't matter really, not when most peoples time preference can be measured in minutes and hours and not in years or decades. Short term you will always be correct - until you're not. Until then, feel free to condescend those with longer term views. In the big picture it matters not.

justintime - I have no clue what point you are trying to make relative to my post. I was clearly responding to the OP's statement that countries were dumping U.S. debt. The data shows it's not true - at least not to date. I said nothing about the long term debt and only cited historical data about foreign holdings of U.S. debt.

there's already been talk among the big banks about instituting negative interest rates on savings accounts here in the US, that's another tax or fee, and it's wrong.

europe has already started doing this.

why?

It's not a tax, it's a fee, and they couldn't even begin charging for debit cards without losing their ass-ets. http://abcnews.go.com/Business/bank-america-drops-plan-debit-card-fee/story?id=14857970

But you really need to read the European version to see whether you think it's right or wrong or how it affects the US since it doesn't. Especially since you are already paying the tax and the European move would actually reduce that tax you are paying today. Weird, isn't it?

First, the negative interest you are talking about is interest on excess reserves held at the central bank by banks. The goal is to stop banks from hoarding excess reserves. It's like the FED charging interest to US banks for excess reserves. So all the European banks need to do is make their assets work rather than hording them at the central bank. So negative interest is a fee that banks would pay to the central bank and whether they passed that on is questionable since it would be more effective and easier for them to just avoid the payment all together.

Why couldn't it happen here then, he asks? First, historically, the US FED has not paid interest on excess reserves and we basically had none. No US bank would ever not make money on money so all money was put to use/work (like loans).

The "magic" of the stimulus where we basically printed a couple of trillion dollars was that with the stimulus, the FED began paying minimal interest on excess reserves in 2008 coincident with the stimulus. If they hadn't, a 2 trillion influx of cash could have "expanded" to 20 trillion in the economy and certainly we would have over heated. And it worked, perhaps too well. Suddenly, the US banking system was awash in excess reserves where before, there was virtually none. And it kept interest rates way low ---- see what a CD pays today as a direct consequence to the FED paying interest on excess reserves.

But, as I spoke many times in the past, US banks took advantage of the new low interest, no risk savings of excess reserves versus lending at higher risks and heavier bureaucracy. Today we have over 2.5T in excess reserves, amazingly close to the size of the stimulus. The interest is low, percentage-wise, .25%, but we have paid $13B as of 4/13. Now that's a TAX, not a fee unless the Fed is paying it from "profits." Additionally, since we took a loan to fund the stimulus, the fact that it's being parked means the loan is no longer working in the economy so the tax we pay every year on the stimulus loan is for an asset that is sitting idle.

Now the time has come for the FED to reduce or eliminate the interest paid on excess reserves. Why wouldn't the FED go negative? Because, historically, in the US, they just don't have to. Our banks will not let the money sit idle bearing zero interest. They have shareholders who would flee. They would lose their collective.....jobs. But to have $2.5T in working capital sitting as excess reserves is not only a TAX on US taxpayers, but a tax that we should just not have to pay six years after the stimulus. It is time to move on, but no need to be negative about it.

Cool stuff huh..... Not so cool in 2009 when I missed it, dumped my stocks to prepare for rising interest, and then sat around with my financial thumb in my....ear...trying to figure out why those rates weren't rising.......

I should add to the above tome that we are really in a pickle. If the FED ended interest payments on excess reserves today, we would at some point have some pretty good inflation.

So they will need to figure a way to drip the excess reserves back into the economy and meanwhile we will continue with our taxpayer sponsored bank welfare program.

High inflation rates will eventually come and wipe away or drastically minimize our debts. It will also create havoc at the same time...

iJay might be correct, however one of the FED's main objectives is to control the amount of cash in the economy. This is both science and art and especially hard since they really can't "count" the amount of cash in the system at all, much less in a timely fashion. But they have been pretty good at this and seemingly getting better. But that does not mean perfect.

Why is controlling the amount of cash important? Simplistically, too much cash = inflation. If everyone has too much cash, it is the one commodity that we have no issue getting rid off and we will just pay more for things to burn it. And if left to continue, at some point either you run out of cash (either don't have it or what you have is not worth anything). Too little cash = recession. If everyone is tight, they tend to save more, not buy as much, you know, hoard that most precious of commodities. And when no one is buying, no one is working, and the death spiral starts.

To "control" the amount of cash in the system, the FED uses interest. While it really does not make sense to control cash by controlling loan rates, they sort of have made it work. In the current example, the FED used interest to convince the banks to take excess cash and put it under the FED mattress as excess reserves effectively taking the excess cash out of the system and getting inflation low. It was a brilliant move, however, that is one of the reasons that our growth is moving slowly.

What it did was let the Gov put a massive infusion of cash, aka stimulus, into the system where it churned an expenditure or two, but then basically ended up back at the FED rather than continue to expand our cash supply and cause inflation.

If the FED removes the interest, then the frozen $2T hits the streets as loans and ultimately would expand the available cash by $20T via monetary expansion based on a 10% reserve requirement. An infusion of $20T into the money supply would be very inflationary but we all would have some fun.......for awhile before the crash.

But the FED has been pretty good on inflastion control; we have not gone above 4% inflation since 1991 and 10% since 1981. And while offering interest on excess reserves combined with tightening loan laws was a brilliant move to curb inflation, the time has come to begin releasing that cash into the system and remove the TAX we pay to cover the interest. They need to start making that money work the way our capitalistic economy intended.

By the by, in 2009 we had deflation or negative inflation. Not enough money aka recession.

But why not enough money?

Because debt is the primary creator of money in our economic system, and when the private sector decided beginning in 2008, to payoff (or default on) their obligations private debt went down (which equates to the destruction of that money per fractional reserve banking rules). That being completely unacceptable to our debt based economy, who had to step in and take on new debt, and thus create new money, to keep the system from failing? The US government in the form of US treasuries, aided by the Federal Reserve. Which is why the rhetoric of wanting paying off our debt is a complete lie. The only thing that *may* happen is that the debt gets transferred to another entity. But who? Foreign governments, having problems of their own, have backed off (I read something like 60% of our new debt last year was "bought" by the Federal Reserve), and so far private businesses have not stepped up to the plate to burden themselves with more debt. The biggest debt issuance I can see now is from consumers. While mortgages are still not generating the debt creation they once did, credit cards are roaring back. Then there is student loan debt - wow! Thank you to our young adults for helping to keep our economic system going by getting yourselves into enormous debt, paying for services that realistically should cost nowhere near what colleges are charging. Oh, and who has been encouraging student loan debt and offering loans to a majority of students (and who is now offering assistance to those who cannot pay for those loans)? Not coincidentally, the federal government of course!

It's a pickle right now, especially given the monetary system requirement to continually add more debt or self destruct. Have you seen the M2 velocity numbers? Not great for an economy that is supposed to be in a recovery:

http://research.stlouisfed.org/fred2/series/M2V/

Surely, if the current trend continues the federal government (meaning all of us via taxation) will be the ones taking on primary responsibility for the majority of debt in our economy. How did we get to this point? By not paying attention and by blindly "trusting" our politicians.

Those of you who made fun of the OP - shame on you for your ignorance. If it makes you feel better, short term you are right. But long term, given the preponderance of evidence to the contrary, you will be very, very wrong.

To the OP: I'd suggest not to stress over this subject but keep learning and talking about this with your family and friends. Sooner or later understanding will sink in, (assuming people can get over blaming "the other guy" and realize that we are to blame for allowing this nonsense to continue for so long). Those pulling the strings of our economy have been able to get multiple rabbits out of the hat, and I'm sure there are some more tricks they have up their sleeve. The cost of doing so, however, will manifest itself in our standard of living as their solutions consist primarily of passing along the debt to the citizenship.

'Those of you who made fun of the OP - shame on you for your ignorance. If it makes you feel better, short term you are right. But long term, given the preponderance of evidence to the contrary, you will be very, very wrong.'

jit: Ignorance? I call it pragmatism. OP wrote of IMMEDIATE impending doom, murder, chaos, and Obama instituting martial law, etc. Ain't happenin'. Then the OP proceeded to try and ward off 'useless and troll comments'. I'd call the original post useless and trolling for 'woe is us' apocalyptic comments, tyvm. We'll be just fine. Everyone gripes about their government (well, maybe save for the Norwegians, they're apparently a very happy and healthy bunch from what I've read). Ours happens to be a little less inept than most. It will be ok.

Well, perhaps ignorance was the wrong word to use MeisterNJ. Earlier I wrote:

"...it doesn't matter really, not when most peoples time preference can be measured in minutes and hours and not in years or decades. Short term you will always be correct - until you're not."

Choosing short term gains over long term stability is, in MY opinion, a foolhardy thing to do as a society. Great for individuals seeking riches, yes, but bad for society in general. And while I don't agree with the "impending doom" mantra (impending societal pain, yes, but not doom ;-)), there is an undeniable fundamental problem with our monetary system in that it now must be sustained by continually adding more of what ails us - debt. That wasn't the case prior to the last radical change (completely removing gold convertibility).

So we will see another change in our monetary system due to the stresses of that which you would like to discount, of that I'm certain (seems to happen every half century or so), and given the huge disparity of wealth today surely there will be some pain involved. But unless the solution involves further wars (historically the "solution" to monetary problems), I agree, no doom.

It's nice when economics and zen seem to merge surrounded by weasel-worded generalities and subtle meanderings. Yes grasshopper, fiat money is primarily debt-based. Uh, yeah, that's the definition Master.....

But Grasshopper, if debt is created it will ultimately be passed to the people. Uh, it was first created as the people's debt Master.

And so if debt is what ails us, your conclusion is a return to the gold standard? Is that the secret of long term stability and no more 50-year corrections? Because, if memory serves, I could of sworn we were on the Gold Standard before, during and after, the Great Depression, not that the Gold Standard caused it, but it sure didn't help it. But is that your systemic improvement to create long-term stability and end corrections like our recent great recession?

Meanwhile, yes, there may be doom. One never knows and as our last escapade showed, it's easier than you think to find yourself standing on the brink.

Could a complete economic collapse may be in the near future? There will be a time when we are asked to pay the piper. When this day comes .... we'll have big problems.

Restraint is what I've always said is needed. It could be a gold standard, or it could be something else. I don't know.

What I do know is that when misterg falls into his arrogant, snide name calling pattern it means he feels threatened. Why that is, I have no idea. I just wish he would knock it off.

Yeah, I called you Master, sorry if you took offense to poor attempts at humor.

But really, take a stand, have a point: "It could be a gold standard, or it could be something else. I don't know." That was my point. Just say, "I don't know" like you just did instead of the prophetical weasel worded: "So we will see another change in our monetary system due to the stresses of that which you would like to discount, of that I'm certain (seems to happen every half century or so), and given the huge disparity of wealth today surely there will be some pain involved." My goodness, under any economic system that statement is bound to be true, someday, somehow, somewhere.

No, I am not threatened, I was actually enjoying your well-thought out response until you left the reservation.

Type... delete...

I haven't posted for a while because I can't stand your arrogant and childish responses when you don't understand something I write. Eh, so be it. But before I leave again, I'd like to point out that almost everything you wrote above first came from *me* back in the 2008 period, the same period in which you adamantly disagreed with me and pulled this same childish crap when you didn't understand then. I guess I have to wait another 4 years before you'll understand what I write today. Good grief.

I have not changed my economic thoughts so we can debate who is older and if you can't take a little ribbing in our duolog, then indeed, you should not post. A win-win. Also, there is little chance you talked about the Fed's paying interest on excess reserves in 2008; the Fed did not even announce it until 10.6.2008.

Meanwhile, on the gold standard, and yes, you have clung to that: "there is an undeniable fundamental problem with our monetary system in that it now must be sustained by continually adding more of what ails us - debt. That wasn't the case prior to the last radical change (completely removing gold convertibility)."

OK, first you ask yourself: what monetary system were we under when The Great Depression hit?

Then ask yourself: what economic system did we leave to fix financial crisis before WWI. And what economic system did we abandon, by Roosevelt, in 1933 to aid monetary repair during The Great Depression?

The first article compares gold standard inflation, or lack thereof or wild inflation swings, with level-set QE-based inflation: http://www.theatlantic.com/business/archive/2012/08/why-the-gold-standard-is-the-worlds-worst-economic-idea-in-2-charts/261552/

Internationally, the Gold Standard is a mess since countries don't necessarily play by the rules. And your entire economy can be affected by another country striking it rich with a new gold find. Last time round, it was Belgium and France that rocked our gold boat.

Domestically while gold stabilizes prices in the long term, (controls inflation), in the short term it wrecks havoc with prices in the same way as International. The 1848 California gold rush caused instant inflation nationwide.

The only way a Gold Standard would work would be if all nations agreed and honored playing by the same rules and if the new gold standard deployed was created with many of the attributes of a fiat monetary system. Otherwise it historically did not perform well and would not in the future.

At some point if we do not control spending our economy will collapse. At what point nobody knows 150 Trillion, 200 Trillion, ...

jd2, all the Atlantic article does is say "hey, don't change anything because there is *no* other way to run things". Fact is, it will change, whether any of us want it to or not.

I think most people like our easy-money, no-restraint system because it satisfies our needs - today. It works and does not require any thought by the populous to live within it, except with a few simple rules: Spend as much as you want on anything you desire, using debt as the tool of choice; what little money you are encouraged to save, don't put it under a mattress, rather put it all in the stock market where you will magically "earn" money with zero effort of your own, in the process placing your trust in the system as well as others to be "responsible" with your hard earn savings; buy a home having a mortgage; and send all of our youth to college using student loans.

I wasn't born yesterday, and it's not like I don't understand what that article is saying. Rather, I continually get the feeling that no one wants to hear the other side of the story, the negative consequences that come from that system. In fact, it seems to me that most want to simply ignore the negative, instead closing their eyes to the fact that *in the current system* the negative *will* win out over the positive (mathematical certainty) in the long run. It shows up in every macro trend available, yet still so many want to simply ignore it. I just don't get it.

Why is everyone so afraid to change the current system but not afraid that by not changing it outcomes will be worse? Again, I just don't get it.

jit, I say only this:

"...does not require any thought by the populous to live within it..."

I agree that the populace should not have to think about its monetary system.

"....except with a few simple rules: Spend as much as you want on anything you desire...."

I disagree that any such rule exists.

I've been hearing for decades now about how our system is on the verge of collapse. Hasn't happened yet, although I agree it could happen.

It is always easier to see the negatives in any current system (economics or anything else); much harder to see the negatives in a system one wants to see in its stead. So it will be always.

My last comment: I'm by no means fully understanding how our economic system works!

When you mix macro and micro economics you get a mish mosh.

Personal debt and public debt are very different things, however, both have similar aspects. If your personal debt ratio against earnings rises too high, you will probably go bust and while protections for debtors are in place, they will not save you. Not much else will be affected. If our public debt against GDP rises too high, the system will crash and everyone will suffer greatly whether in debt or solvent. And we not come back for a long, long time, if at all.

Very different things.

So, the facts: we all know where the public debt is, very high, highest in over half a century, been there before, took 35 years of hard work and sacrifice to fix. No idea of how high is too high but, IMHO, we are too high and we don't want to test the limit. Picture shows the history, think we are at 99% in 2013 and will waffle between there and 104% for the next 3 years.

For personal debt, we have a very different story. Household debt has been growing smaller since 4Q2008. The first uptick since then was 3Q2013. 70% of our personal debt is in our homes; seems like a good investment given you budget right; 9% is education which if stats are right should provide a decent ROI if advanced degrees are achieved. 8% in our cars, gotta have em to work, and 6% in credit card, but that's misleading since, for example, I run up quite a credit card debt but yet never pay any interest or service fees. Not a perfect story, not a precipitous drop, but certainly not the same story as public debt. And the number is $11.28T which is about 10% below our 2008 peak. Our Debt Service Ratio is under 10% as in 10% of our disposable income is spent on debt, in 2008 it was 13% and in 35 years of tracking has only gone under 10% starting in 2012. Our Financial Obligations Ratio (includes debt, rent, taxes, etc.) is 15.4%, was almost 18% in 2008.

So very different trajectories for personal and public debt proving JIT's point, but only at the public level where our elected officials need to do more to get spending under control. The easiest fast fix IMHO is to reinstate the Bush tax cuts BUT earmark them to paying down the debt for a decade and then they can vote on it, like the debt ceiling. Still won't be enough and they will probably use it as a crutch, but it's a start.

"....in the current system* the negative *will* win out over the positive (mathematical certainty) in the long run."

I'm not asking if this is true, but I WOULD like to know, is this statement generally held to be true by economists?

I am in the same boat as Just in time and jd2 as to "I'm by no means fully understanding how our economic system works!" and I am not alone. I never invested in the market. I always thought it was like going to AC, because I know nothing about it. I just invested in my house and banking.

I just know that printing money in the long run causes a devaluation of the dolor and in the long run pain for many. Most politicians don't care but when we got into selective bail outs and stiffing Bond holders it was new territory.

"but I WOULD like to know, is this statement generally held to be true by economists?"

jd2, not by those who participate and control the current system. If it were, you'd hear it stated as such on the major news networks. There are other economic schools of thought, and each of those contain some form of restraint system and are therefore typically ridiculed as being nonfunctional nonsense by current economists (who, by definition, work within the current system). It's from each of those groups that you will hear discussion of the unsustainability of our current system.

As I've said before, I'm a trends guy and tend gloss over short term facts and figures and try to see how they fit into the bigger picture. The big problem is not that there is any impending "doom" today (although major hiccups here and there are extremely likely given how the system is setup), but rather a long term trend pointing one way, and one way only, to unsustainability (especially when you take into account all of the entitlement promises that have been made without any real way to follow through except by continuing (in a BIG way) the trends I've been talking about. It really isn't that hard to see - as I've said, lots of stuff at the St Louis Fed site:

http://research.stlouisfed.org/fred2/categories

Money, Banking and Finance has a bunch of 'em under Monetary Data. The only thing I will say about it is to make sure you choose the longest time period possible so you can put recent history into perspective; all of the short-term graphs don't tell the whole trend story.

I would think there are many well-respected economists who do not "participate and control the current system", such as academics. What say most of those?

So, jit, is your view an extreme one ("acknowledging that "extreme" can still be correct)?

Forgot to add jd2, if you know a math major ask him about the doubling time in an exponential equation. I've mentioned it before, but consider what happens to the time axis the further out an exponential curve you go - it takes shorter and shorter periods of time for the doubling of the Y axis (look at the Fed graphs I mentioned in my previous post). So while "doubling time" doesn't "feel" too bad today, it will at some point - it must. (Please, I'm not saying this will be tomorrow - it won't be. Keep this in the long term perspective with the graphs noted above)

Given the incredible amount of "unfunded liabilities" (I have seen numbers range from $125T to $225T from various sources), a population that is already heavily taxed, and a continual lowering of the national interest rate, a "debt spiral" isn't exactly an odd thing to expect.

Any argument otherwise is one that simply believes there is always a way to manipulate the math. That being true, try to remember as time moves forward who will be continue to be targeted as a source of revenue to keep our broken system funded. It's not hard, because that trend too has been with us for a while (99% vs 1%)

Not extreme whatsoever jd2. Some will say that, of course, because I'll always argue for restraint in any system controlled by human beings.

Google Keynesian vs. Austrian economics and read some of the back and forth, but even that isn't really what I think you're asking for.

Even the current Keynesian school does not condone perpetual debt - that is a US manipulation of Keynesian theory. Keynes proposed for deficit spending during a crisis to prevent major recessions or depressions. A great concept, and I don't have a problem with it in theory. But, he also said that the economy must return to a healthy state so that the next time deficit spending is required the nation could handle it. That's really all I've been trying to argue, that some type of restraint system *must* exist otherwise our economy becomes a free-for-all (which it has been for quite some time).

But looking at any of the graphs I've linked to in the past, do they paint a picture of a nation that's been acting with restraint and prudence (at least since the last vestiges of restraint were removed in 1971 by Nixon)? Has the US been bouncing back to "normal" after each economic disruption? No, and there is no way to argue otherwise because the data shows the reality.

I think the reason that this isn't discussed in the general media is because people *like* getting things from their government. Who wouldn't? Try to tell people that they've been supporting an irresponsible government that's been using an irresponsible economic system and what kind of reaction do you suppose you'd get (hint - I get the reaction all the time from one who knows a thing or two about gaming the system).

Anyway, please DON'T BELIEVE ME. I beg you, don't. But what I'd also ask is for everyone to spend time looking at our economic system from 1000 feet instead of from the usual perspective that's presented in the media (usually something about the government wanting to take something or offer something to you).

Think trends...

"....in the current system* the negative *will* win out over the positive (mathematical certainty) in the long run."

So I was focusing on your statement of the "mathematical certainty" of the present system going bad. I thought you meant that the monetary system was flawed in absolute terms. Now it looks like you are saying it will go bad only because of irresponsible behavior. Surely irresponsible behavior is not a *mathematical* certainty.

How about this jd2:

- Because of the way our system is setup - debt based - ever increasing debt is required to prevent the total quantity of money in our economy from declining, otherwise we will experience "deflation". Most agree that deflation is bad for our current system, yes?

- As more debt is incurred, more money is required to pay the interest on that debt. Typically, in our system that money is created through even more borrowing.

- One way the Fed has managed the interest problem (at the Federal level) is by lowering the federal funds rate, which has been almost at zero for the past several years. They can't go any lower unless they introduce negative interest rates, at which point we would have to pay a bank to hold onto our money (which few would do). Any bump in the federal funds rate makes the debt problem worse, meaning faster and larger debt creation.

Follow? Our system is requires more debt to payoff previous debts, otherwise deflation. If we increase the pace of borrowing, and if the system remains unchanged, there would be a corresponding increase in additional borrowing needed due to the interest requirement. IOW, the faster we borrow, the more we need to borrow. I realize this can't be boiled down to 1000 words or less on a forum, but that's the gist of the situation and is reflected in the graphs I referenced.

So to answer your question, yes, it is a mathematical certainty that the system will become unsustainable at some point - unless it changes. Which I'm sure it will once the pain from the current system becomes too much.

Depressions and recessions slow down the pace, as does any type of deflation. Since no one enjoys any of those, the typical solution has been to pile on even more debt, pushing us further toward a doubling time that will become painful. If you can see a way to reverse the trend I'm all ears. So far, based solely on the graphs presented, it hasn't happened. Not once since the Federal Reserve came into existence. The path forward is pretty well defined by even an untrained eye I'd think.

I too do not know much about the economy or I would be financially free. But I have learned from these discussions; for example JIT taught me that the value of our dollar has always been shrinking and that the FED is a mysterious place without transparency. Good stuff.

First, you can't get a group of economists together and expect agreement; it's an art and a science. Second, the best any economist can do is to tell you exactly why a recession occurred, as soon as it is over...... Third, and this is the one to live by, wherever we are in the economy, we have never been there before which is why we can discuss forever. Recently we went through The Great Recession and we printed a lot of money which should have created massive inflation and dollar devaluation. It didn’t because the FED began paying interest on excess bank reserves. We have never been there in the economy before.

Because we use fiat money, which is debt by definition, our monetary system is based on either debt or faith in the value of the products and services of America, in other words, our economic value. You be the judge as to which it is.

This is different, although similar, to our debt incurred by spending more than we take in, the deficit, which has created the large debt/GDP ratio we have today.

So two sources of debt, one created by creating money, the second created by spending more than we take in with taxes, fees, etc.

And then the third source of debt, household debt, incurred when each of us basically spends more than we can take it. Again, similar but very different than our public debt.

By it's very nature, fiat money being debt, the value of our dollar decreases over time because a little inflation is better than a little deflation. However, inflation need not spike wildly IF the amount of money created closely approximates our perceived economic value as a nation.

Sounds scary, right? Faith, economic value, all nebulous words.

And so some believe a fixed commodity based currency provides restraint by "pegging" the value of our dollar to a fixed form of value like gold, silver, or pineapples. Sure, now you have a pile of gold and you can print dollars to match. However, now you are fixed and IF something occurs, let's say The Great Depression, there's nothing you can do because your money supply is fixed, it's cooked, and you’re done. Instead, what we did in The Great Recession was say, uh oh, we going belly up, print a lot of money, keep the factories/businesses open, keep the banks open, bail out the foreclosed, save those hurricane victims, keep people working, give people a reason not to hide the money in the mattress but trade-in clunkers for new, increase the energy efficiency on their homes, have some extra cash to pay those regular bills. And we did not have a Great Depression like we did under the Gold Standard.

And the recession was not caused by too much debt but rather toxic mortgages and too much assumed financial risk. So you had a small recession due to trade imbalance and money moving off-shore which caused financiers to increase the risk of their holdings followed by crunched interest rates which crunched toxic mortgages and the shaky financial vehicles tied to them and then the other risky investments came tumbling down to the point of “breaking the banks.” See, it’s easy to say why it happened……….now.

But ask yourself this: today there are over 700 entities on fiat monetary systems. In the past, every single Gold Standard went belly up, some during huge disasters. Even we did not stick to the Gold Standard before Nixon and regularly abandoned it in times of stress. During the Gold Rush, inflation was rampant. Why, because a fixed commodity monetary system does not work and never has. But we are getting through The Great Recession under the fiat monetary system with just a tweak to pay interest on excess reserves (which, incidentally was a law passed before the recession but not implemented).

JIT is right; we have spent, and are spending more than we take in via taxes. It needs to be fixed now, and we need, IMHO, to also bring down the debt. Not because of payments, our economy is robust enough to handle that, but because of faith and the thought that want more faith, not less, so we need to sacrifice, spend smart, and lead the world in prudent financial action. But that's a different debt than the core concept of fiat money and we don't need to change that to be successful.

And we don't need to just cut spending. JIT is wrong is saying we are heavily taxed. We have not been taxed this lightly in decades. Decades. And during The Great Recession, one of the mechanisms used was even lower taxes. As I have said a number of times, we need to cut spending, wisely, but we should stop the Bush tax cuts, earmark the money to the debt for a decade (and then vote on possible extension). We can raise the bridge and lower the water at the same time.

Okay, thanks JIT and MG, that's plenty to absorb for now! Definitely learning something.

As to governmental spending and taxes, I agree both have to be set at the right level, as best as we can tell what that may be. Politicians buy votes by promising benefits that should not be provided, and other politicians buy votes by promising tax cuts that undermine the balance between the services people expect and the revenues needed to pay for them.

salaries stagnant, gas and food prices inflated leaves us in a bad spot.

average income earnings have gone down over the last 15 years while food and fuel continue to rise , a lot.

this is bad, and is partly because our money is based on thin air, there is nothing to back it up, and they just keep printing more and more dollars, every month (isn't it like 80 billion a month of new money injected into the economy?)

i like gold becuase it's tangible, it's real, gold is a good way to hedge your bets against inflationary loss due to a worthless paper backed economy, silver too, also good because it is real and tangible,

the paper backed promissory notes for the fed are just that, empty promises

it's because the fed keeps printing money that the cost of real goods, (oil, coffee, corn, iron ore, coal, steel) goes up, as our dollar looses value, it takes more dollars to buy the same real tangible items.

over 50 to 100 years this can be really bad for the health of our nation,

we need to show some discipline right now to change things.

FYI, fiat only means that the value of currency is via government decree - there is no commodity in which to value the currency and it's value is set by governing laws.

Our monetary system is debt based, and thus our currency is an instrument of that debt. It is stated as such on every bill issued: "This note is legal tender for all debts, public and private"

There's nothing that prevents the US from changing the law and using some other method to value our currency.

"Let there be light" and fiat currency are both the same thing... do you believe in magic...

"the value of currency is via government decree"

this is true and is why our money is losing value, it is based on nothing.

as the cost of real goods (coffee, gas, oil, corn, soy beans, iron ore, coal etc) goes up and we keep earning the same number of dollars or less as Americans average salaries have declined over the last 15 years we all are living a lower quality of life than in the the past.

the numbers bear this out and is a direct result of the declining value of the US dollar as it is backed by nothing other than Federal fiat.

what a joke. really.

"the value of currency is via government decree"

No, this isn't true. The value is determined by a modified free float process.

http://useconomy.about.com/od/tradepolicy/p/Dollar_Value.htm

And darn, the value of the dollar has been increasing since 2011 so I am guessing you might find some others causes fer yer woes, which indeed are well grounded if not well understood.

We, most everyone that is, have moved over to the fiat system for a reason. Its problems seem to be more manageable than the problems of any other system.

We've tried the other systems, and found them wanting.

over the last 20 years dollars have lost value and purchasing power,

the cost of coffee, oil, corn, food, clothing, shoes and other real goods has gone up

because the value of the dollar has been eroded due to inflation

We as Americans earn less in average salaries over the last 15 years and thereby we are feeling this pinch on both ends,

having fewer dollars coming into the household and then having to pay a higher number of dollars to obtain the same real goods (food, fuel, etc) hurts us all from both ends for a big double whammy to the face.

Americans average salaries have declined over the last 15 years and we are living a lower quality of life than in the the past because of this double whammy.

not hard to understand the drivers of this trend, and we need to change it

the value of the dollar is based on nothing but thin air, false government promises and it hurts the nation over the long time frame.

those who have eyes, let them see

Certainly you can't believe that if we went off a fiat money supply that all those issues would be resolved?

Right, misterg. If the dollar were fixed against some valuable commodity, the dollar would be more likely to retain its value. The problem for a lot of people then would be that.... they will have few dollars, or no dollars.

The barter system, anyone?

Actually when you look at the article from The Atlantic t I posted above, the dollar pegged to gold had much more inflation and even deflation than the dollar say since QE started. So much for printing money = inflation. The myth that pegging the dollar to gold retains value and is immune to inflation and deflation is exactly that.

Especially when other countries go to gold and start manipulating on a world-wide basis.

And most of BDog's laments have less to do with our fiat monetary system and more to do with other factors anyway. I mean if he thinks our salaries are going down because of fiat money, then why are the salaries of the upper tier(s) not subject to the same? They are not, only the middle is suffering so what's up with that if everyone uses fiat money?

gold has been a good hedge against inflation because it's real

it's good to invest in real things other than just paper back promises (empty promises)

our money gets a little bit cheaper every day, loses it's value,

real things are tangible and retain their worth better, paper is just that, paper.

this is over a long period of time, like 50 to 100 years, long term trends do not look good for us economically the longer we just keep printing money that is not backed up by anything solid

this is not that hard to grasp yet it seems to be beyond many, not sure why.

"gold has been a good hedge against inflation because it's real"

"real things are tangible and retain their worth better, paper is just that, paper"

"this is not that hard to grasp yet it seems to be beyond many, not sure why"

It's hard for many of us the grasp because it's not really true.

The available data says you are wrong about gold as a hedge against inflation. Check out the following example provided by CBS Money Watch. You probably would have done better if you hedged using canned fruit! No lie! Fact is that the value of tangible things often goes down - real estate is a good contemporary example.

CBS Money Watch says: "Should I buy gold as a hedge against inflation?" Many, if not most, investors seem to think of the metal as a good way to protect themselves against unexpected price hikes. And they're dead wrong.

Gold can help offset some economic and geopolitical risks, but it's a poor hedge against inflation, as the following example illustrates.

On Jan. 21, 1980, the price of gold hit the then-record high of $850. By the end of the year, it had fallen to $590, a drop of more than 30 percent. By March 19, 1982, it reached just $316, a fall of 63 percent. On March 19, 2002, gold traded at $293, below where it was 20 years earlier.

The inflation rate for the period 1980-2001 was 3.9 percent. A gold investor who was unlucky enough to have bought at that $850 peak not only would have seen the investment fall by 65 percent in nominal terms by the spring of 2002, but also would have experienced a real loss in purchasing power of about 85 percent. Given this abysmal performance, gold cannot possibly be considered a good hedge against inflation.

RAD - You're absolutely right, gold is more reputation than reality. In addition, look at the recent gold price plunges. It's no safe investment at all. Maybe it's more about remembering the past and times like the 70's where there was such a run on it.

Tangibility is one thing, but what exactly can you do with gold besides hold it in your hand? In inflationary times, making jewelery has probably lost some luster to it. It can be tangible but if no one wants it or its easily obtainable, it's practically worthless. I can hold salt in my hand, but will anyone pay $1000 an ounce for it? Gold's desirability is as capricious as that piece of paper.

There are commodities that are certainly sought after, but that's such a rotating market people make fortunes and go bust on a whim. I used to say oil looked like it would be a gold replacement, but even that has alternatives like natural gas that's not so safe either.

Plus today will inflation be a huge concern in the near future? We're going through near deflation in some areas to the point you wonder where the future will be. I don't minimize the over spending any, its wrong to keep going into big debt. But world economics can't be written off as simple.

RAD you're correct, not in the current monetary system, no.

But before that, before the Federal Reserve system? Yes, of course. That's why fiat was implemented, because hard currencies were difficult to "game", to manipulate - governments couldn't inflate the way they can fiat.

jd2:

"Right, misterg. If the dollar were fixed against some valuable commodity, the dollar would be more likely to retain its value. The problem for a lot of people then would be that.... they will have few dollars, or no dollars."

Problem is, the short term "wealth" you are referring to has a cost, and that's debt. Just who will be responsible for it so that you can have a few extra dollars to buy stuff you don't need? Not you, not me and certainly not misterg. Then who? And when will they be called upon to repay the debt? No one, everyone? Never?

I think you and misterg are talking all the right talking points, except the point about who will be responsible for the debt creation that was necessary to get you those few extra dollars (while the 1% takes the majority of them) that result in the excess money you are referring to. Again, the system will fail, and fail in a big way when it ends. I suppose that's OK as long as you and misterg (and many others, as well) are getting yours today? No problem it that's the case, but please don't take lightly the view of others who do consider the ramifications of the choices made today on our children's generation.

Again, we can have growth while at the same time requiring restraint in our monetary system. We just have to stop collectively thinking selfishly and think about not only the end result but the process it takes to get there.

But sigh, that will never happen. Don't know what's wrong with me that I care about stuff like this. I should just go and buy everything I desire, run up wads and wads of debt, then figure out a way to get a bailout like everyone else gets these days...

the long term view is given for a reason, because it's right

taking the 1980 time frame to 2002 is going to give a skewed view, so the source article is flawed, but it does give ammo to the ones who want a fiat paper based system and keep the status quo going because the alternative is not comfortable to deal with responsibly

50 - 75 - 100 years is given because that normalizes for those 20 year runs ups and busts the article documented, so if you bought gold in 2007 at 600 and sold it last year at 1800 you would have seen a 300 % increase, but that also is a cherry picked anomaly that gives a skewed view of the overall relative value of gold. not good to take the short term view, and yes 20 years or 7 years are both short term views when talking about the financial health of our nation.

50 - 75 - 100 year time frame helps to protect wealth from the ravages of inflation caused by irresponsible fiscal policy

and it's not all that complicated unless you add in a bunch of bunk and smoke, and smoke screens and 3 card montie which is used regularly by the fed in it's current make-up, this is not good and one day the house of cards will fall, gold will still be worth more than useless paper notes.

"But world economics can't be written off as simple."

So true. Which is why one might ask why Central banks of the world have been steadily collecting that relic called gold, 370 tons or so in 2013 (not all of them, of course, but totals continually increasing since 2008). Then there's Germany, who last year told the Fed they wanted to repatriate their gold to placate those fearful of being dependent on the US. It was to be spread out over the next ten years. Then recently, Germany switched course again and decided to leave it's gold where it is. A little odd that is, that a country can't take immediate possession of that which it owns, especially when it's a worthless bit of metal, and even more odd when it seems that the resistance to relinquishing the metal seems to have resulted in political cancelling of the request.

Point is, don't think gold is irrelevant. Hardly, otherwise central banks (our own being the largest holder of gold in the world) wouldn't keep the metal. It is still, in fact, very relevant. Take Russian and China for instance, two countries that are on the "power move", the have been steadily adding to their reserves. There must be some reason to hold gold if sovereign country's view it as a sign of strength.

But back to the topic at hand: Debt.

"Again, the system will fail, and fail in a big way when it ends. I suppose that's OK as long as you and misterg (and many others, as well) are getting yours today?"

Who's snarky now? I worked for mine so you can........move on.

Again, you are mixing different types of debt to come up with your scenario of doom (even you don't think it will happen except when you do think it will happen......) OK, so you say it's inevitable. I say who cares, we already know that pegging dollars to gold has failed over and over and over..... We know that gold faces tremendous dips and spikes in inflation. We know that gold will be manipulated by the very countries you quoted as stockpiling against us. Much harder to do with a free-floating exchange.

The debt created by printing money has proven to be manageable and it IS backed by the strongest asset in the world ---- the productivity and worth of Americans. Want proof, check the value of the dollar, looks pretty good on a global basis as a value and as the MAIN global form of money.

The debt created by spending more that we take in is OK if done in moderation for good things ---- like a prudent mortgage creates value. But we all agree it's too high and must come down as I noted above many times. We don't agree that the stimulus was a "free lunch" of "you got yours" but a necessary tool to stave off a depression. Wish we used this tool in the Great Depression.

But quit acting like these two forms of debt are one in the same and just because we took out a HUGE loan that will be very tough to repay does not mean the debt created by having a fiat money system is bad too.

Meanwhile --- gold purchases. Interesting especially since it's gold and not just an index buy or paper purchase. However it can be just an asset and I can't see what other assets foreign banks have but US banks have a number of them. Would have more except for regulation. But here's a funny link and you can get a clip too; Bernanke sounds pretty silly: http://www.theatlantic.com/business/archive/2011/07/bernanke-to-ron-paul-gold-isnt-money/241903/ But the gold purchases are interesting.

BDog: finally a great post. Yes, I noted the time difference and all I can say is the author was saying two things: first, gold is not inflation/deflation proof --- that is true. Second, fiat money can provide a stable money supply and stable inflation --- that is true.

What he left out was for fiat money ---- it ain't necessarily so all the time, just like gold. And if I thought it was always going to be true then I wouldn't believe in my economic precepts I noted above, primarily that at any given point of time in the economy, you have never been there before. Therefore, to expect economists and the Fed to continually get it perfect would be stupid.

But Dog, I will add that in the long term view, there is one economic truth. We will all be dead :>)

"But Dog, I will add that in the long term view, there is one economic truth. We will all be dead "

Young people don't think 50-75-100 years out. Old people like me don't either, but for an entirely different reason.

one day the house of cards will fall, and gold will be worth more than useless paper notes.

Buy gold if you wish. May be worthwhile, who knows? The issue here is whether a system of money should be based on it, not, does it has value. Of course it has value.

As one man stated, the value (true value) is not in the gold or us dollar bills, or amount of bullets, etc, it is in the energy.

"one day the house of cards will fall, and gold will be worth more than useless paper notes."

And when that day happens, copper and lead will be worth more than gold.

"one day the house of cards will fall, and gold will be worth more than useless paper notes."

Consider this. If any government holding gold decided to start selling it off the value of gold would absolutely crash. In other words those shady government characters that manipulate the paper money supply could easily wipe out the gold bugs in a heartbeat. Look at the sudden drop last year when people thought Cyprus was going to start selling gold. There is really not much reason for the U.S. government to hold gold except for tradition and the fact that the value would precipitously drop if they tried to sell it.

Came across this due to jd2's post in another thread, and thought it interesting enough to share.

http://davidstockmanscontracorner.com/sarajevo-is-the-fulcrum-of-modern-history-the-great-war-and-its-terrible-aftermath/

The longish missive meanders quite a bit, but the part about the origins of the Federal reserve and the first great depression relate to this discussion, his descriptions giving credence to the "watch the trends" line of thinking that I have been talking about.

Just found this as well:

http://www.peakprosperity.com/crashcourse/chapter-3-exponential-growth

A shortish video describing the exponential growth issue I've discussed above.

...and it's followup...

http://www.peakprosperity.com/crashcourse/chapter-4-compounding-problem

The David Stockman piece is an interesting take on monetary events started in 1914. It does indeed cause one to look at the present stock market run-up and what-have-you with some dread. (Actually, I already had some dread anyway.)

I think Stockman gets a little carried away, but is he mostly right? Would love to see a response by someone like Ben Bernanke.

Yes, Stockman is a passionate man about communicating what he believes to be true. If, in fact, he's correct his passion is warranted. Problem is, is he correct? I personally believe his baseline is correct, but he wanders too much for my taste.

Talking about big picture views, the "Crash Course" series is one of the best summaries I've seen in a while (admittedly because my confirmation bias is in overdrive at the moment ;-)). Without spending an entire four plus hours watching the full series, I just watched their one hour summary and found it's big-picture view to be spot on. So of course I'd recommend everyone watch and make a judgement for themselves (especially those who had a problem with the OP's initial comments):

http://www.peakprosperity.com/crashcourse/accelerated

Like the author, I look at the information not from a doom and gloom perspective, but rather from a big picture, what are the trends view. Good choices and decisions can only be made if reality is understood by the majority, and thus a change of course with workable solutions.

For the non-mathematicians reading, here's another series that demonstrates the growth trend problem in a more in depth but simply put manner using real world examples:

http://www.youtube.com/watch?v=F-QA2rkpBSY&list=PL6A1FD147A45EF50D&index=1

Thoroughly examines the exponential trend issues discussed above, and more importantly provides examples of data that can be misinterpreted when exponential use is *not* considered when making energy reserve predictions.

The transcript may be easier: http://www.albartlett.org/presentations/arithmetic_population_energy_transcript_english.html

Since it's obvious we will run out, one can argue the timing, his conclusion make sense along with conservation, efficiency, and effectiveness.

If we are visionary about our strategy, if we put resources to long-term development, I easily see a future with more energy, not less. Our next step, like he says, though is to, uh oh, fund more research renewable, provide incentives for renewable start-ups, etc. Unfortunately there will be ooopsies like Solyndra as well as many a dry well. We need to be critical of failures, learn from them, but realize that's the nature of new. It does not always work on day one. And it will be a long term development, we are probably looking for the spark of genius to come from someone who has not even entered college yet.

Meanwhile, I see great benefits in tax credits for energy efficiency. Europe's and Japan's housing is much more efficient than ours. But it would be good to jump start this since waiting for disaster may be too late. I think it's a good use of public funds, i.e. tax credits, to incent long-term efficiency efforts. When PA used its stimulus this way, I know boiler/furnace installers were busy even during the recession's height. That's better energy efficiency, more American jobs, more taxes paid from those jobs, etc. etc. Seems like a good use of funds to stimulate this for long-term benefits for the everyday common man versus another loophole for the rich or another handout for the poor.

Perhaps hybrid cars, but I think that market is pretty well under way. But electric would be worthy of stimulus too.

That's all well and good misterg, but how does that change the underlying system that for all intents and purposes must continue to rise exponentially (as shown by the undeniable historical trend)? A slight pause may be gained by doing what you propose, but overall the ongoing trend is the same, and there is nothing at a system level that even remotely suggests the trend will change.

And that brings us back to the same point we usually find ourselves: Treat the symptoms or treat the problem? I suppose we should do both, but IMO doing one (treating symptoms) without the other (treating the problem) is like spitting into the wind.

First, it lowers the usage per individual which is always a good thing and will slow the trend or rate of growth.

Second, as the author indicates, renewal energy, if it fits our usage needs, is renewable up until the time that the source disappears (like the sun).

I don't want to treat the symptoms; I want to use more. But use it more efficiently and get it from renewable resources. Just like your author (well, he didn't advocate efficiency to be honest, but I bet he would because, well because, it's efficient)

Just a quick followup to the previous videos from PeakProsperity.com. This one is specifically about the topic of the thread, debt:

http://www.peakprosperity.com/blog/87309/debt-crash-course-chapter-13

It's all about the trends... ;-)

It's an interesting read from a very interesting and eclectic site but I notice much mixing and unmixing of public debt, private debt, GDP, private income, etc. when it suits the authors' needs to make their points.

Think what I am trying to say is: http://theincidentaleconomist.com/wordpress/chris-martensons-crash-course/

And do bear in mind; these boys are selling things either directly or indirectly via "associations" with those selling. Just saying.

The crux of the biscuit from this chapter, the fear that demands your call to action is: "Our debt-based money system has a fundamental shortcoming: it requires infinite growth to remain functional and infinite growth forever is simply not possible." And the rest is about how each of us has too much debt, both personal and public. This means YOU are even in worse shape because I have NO private debt.

But look at the actual GDP chart that totally refutes their cornerstone claim and ask: If these boys are betting 100% dead bang bet-your-salary sure on something that has never happened before, do you want to bet on the rest of their assumed conclusions? Or if we believe in their premise that "it can't last forever," when is that and what happens next?

As the Great Recession of 2008 showed, it can and did happen and what happened next was a long, slow, and painful recovery ---- thus far. A recovery that was fueled by additional public debt to get us by and hopefully will follow by increased GDP and a pay-down of that public debt. During the same period, the private debt was lowered as citizens tightened their belts to do the right thing.

Just saying there's a lot to be worried about, but Americans have proven over and over that we continually figure out how to innovate, create, work harder, be successful and steadily improve our economic situation in this world.

Got a chance to read fully the link you posted misterg. I'm in general agreement, with one exception that happens to be presented by one of the commenters:

http://theincidentaleconomist.com/wordpress/chris-martensons-crash-course/#comment-21137

"“…extrapolations for what they are: warnings of what could be, not what is guaranteed to occur.”

Fundamentally wrong. Dangerously wrong. Extrapolations are guaranteed to occur **unless conditions change**. As long as current conditions and parameters remain the same, we can predict the outcome with virtual certainty. The only time that will not happen is when new factors are introduced to change the conditions."

(emphasis added by me)

I've been looking for the factors that will cause the current trends to change. But I don't see, as of yet, any factors that will cause a change in the current trend, nor do I see anyone actively working toward mitigating the trend. All I see are arguments to maintain the present course. That being the current environment, would you agree it's prudent to acknowledge where we are, where we've been, and where the trends say we are going if nothing changes? Even if you disagree, IMO this is the kind of information that the general public should be aware of if for no other reason that for us to ask ourselves what would happen if we don't do something different.

Regarding using GDP as an indicator that everything is OK, recall that GDP is C + I + G + (X-M)

C=Consumer spending (DOWN)

I=Investment (the stock market has been propped up by FED purchases, not the private sector). UP

G=Government spending. No need to explain that one, we all know it has been through the roof. UP

X-M = Exports minus Imports. Imports have been greater than exports, so this is down.

If the federal government and federal reserve ZIRP/QE components are the primary two things keeping GDP up, thus making the chart you posted more palatable, might that indicate that things are a bit backward at the moment. Then factor in that both I and G were made possible almost exclusively by debt issuance at a governmental level, wouldn't that negate the use of debt being a realistic measure in Debt to GDP as it relates to a "healthy" economy? Take away the debt to gdp ratio and the bulk of just about every other data point paints a different picture.

Remember too that our economic system is one that requires *continual* growth, but the world we live in has real physical limits. So wouldn't it be prudent for this kind of information to be available and understood by a majority rather than a minority? I would love to see this discussed in a mainstream manner. Only then can we "turn the ship" so to speak.

"Remember too that our economic system is one that requires *continual* growth, but the world we live in has real physical limits."

this is true, and i've been saying it for a very long time, there is a finite limit that will be a hard stop to the current economic trends, we may live to see it in our lifetimes,

thanks JIT, very good point and spot on commentary as is usual for you

We probably agree more than not, it's just that I don't see the future in black and white terms in light of the past. No matter what, I believe there will be some change that will make there forecast not true. It's just a change they did not forecast based on past trends.

OK, how bout we start out with some quotes:

"Economics is all about how people make choices. Sociology is all about why they don't have any choices to make." Nat. Bur. of Economics

"The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design." Friedrich August von Hayek

Over the years I have little quotes to guide me and when it comes to the economy, someone said something like "no matter where you are in the economy, you have never been there before." I live by that especially when listening to the historic trend pontificators or just those who tell us what's next.

So you can guess where I come out with the forecast. First, yes, if nothing changes, things will proceed on the current course. I agree. But things will change, timing will differ, and something else all together will probably happen. From my experience, it always does.

Simple example: Inject $1.7T in stimulus in the economy and money supply will grow by $20T. That's what history told us. Didn't happen since Fed began paying interest on excess reserves and now instead of $1.7T injected, instead where we had ZERO in excess reserves, we now have $1.7T. New rules!!!! So yeah, if nothing changes........but something always does.

That does not mean do not fear what the extrapolations portend. But it's the underlying current situation and what happens next that is most important. No doubt we are teetering, but history has shown us teetering like this before and coming up roses (granted 35-years of work, but still.........) So, I am just not going to dump all my equities, buy gold, and invest in a man-safe.

I am not sure I said that our GDP shows everything is OK; anemia is not robust health. What I said was, first, these boys toss economic elements together, split them apart as it fits their narrative --- that's bogus. Second, I think we all agree that our fiat money system, our economic system, everything money depends on GDP growth. I think we and the boys all agree. I was just making the point that these gloom and doom forecasters based on historic trends coupled with a lack of growth seemed to miss the point that the GDP is growing. Seems like a major ooooops to me.

Plus, I alluded to the fact we seemingly just got through the Great Recession and that's flippin amazing. Sure, we aint' out of the economic woods, we got HUGE troubles right here in River City, but amazing that we are still standing.

So I agree we are hurtin, but I think we have come a long way. We have decades of work to do to save our children's future and we better get to it. But we didn't crash and burn.

But of this I am sure; whatever I think about the future of the economy, it won't happen that way. So I look at the history, I look at the trends, I listen to the forecasts, and I try to make my own personal decisions without getting too wed to any of it.

Right now I watch the excess reserves interest and the debt/gdp very closely and for the rest, I guess we can all wait for a new Congress. Any new Congress at this point.

By the by, here's GDP by component over time. Really does not look that bad to me. Am I missing something?

JIT, MG, BD - wondering what you guys think about the economist and now Senator Elizabeth Warren (D-MA). She happened to be on Letterman a couple weeks ago, and the show re-ran last night, so she is in my head. I first read an article by her about 12 years ago, and have been following her with interest ever since. I had the feeling when I read the article way back then that she might be headed towards the Presidency one day, and now we are hearing her name in the same sentence with the words "run in 2016."

I think she is a smart, savvy, person, but I have not reviewed platforms and policies given the Hillary juggernaut pretty much blocks anything else.

Gonna be a sad state of affairs if we end up with Bush III vs. Clinton II.

rebecka - i have not read any of her writings on economics. do you have a link ?

i read her wiki page, and i must say i remember her false claims of 'native american hertitage' and the controversy around it. she was pretty much exposed as a poser, and Harvard listed her as a minority, are you kidding me? that's dishonest right there, don't care for it.

in my view she is kinda of a carpet bagger senator up there in Mass, she was born and raised in Oklahoma, lived in texas with her husband, had a child there and became a stay at home mom. and then moved to NJ where she got her law degree at Rutgers. i don't like carpet baggers, i feel strongly that state senators and house members should be people who have a real history in the jurisdiction they represent. not recent transplants, they cannot know the area they represent as well as someone who grew up there.

she also (according to her wiki page) is the primary architect of obama's infamous line "You didn't build that" which almost lost him reelection.

she is a strong defender of the little guy, in consumer protection and bankruptcy issues and i do kinda like that as i also generally reach out to the underdogs in our society,

i wonder what her position is on the current college loan debt bubble we are all facing, it has delayed young adults from marrying when they want, and delayed them purchasing their first homes, which has a double-whammy adverse affect on the housing market and our economy.

pray tell, what does this (clearly not native american as she has been exposed as a poser about) Elisabeth Warren say about this?

also what does she think about our current economic trends? and where they are going?

http://en.wikipedia.org/wiki/Elizabeth_Warren